Universal life insurance is a type of permanent life insurance that offers flexibility and control over your coverage and premiums. Unlike term life insurance, which provides coverage for a set period, universal life insurance offers lifelong coverage, with the option to adjust your premiums and death benefit as your needs change.

This flexibility stems from the cash value component of universal life insurance, which acts like a savings account that grows over time. The cash value can be accessed through withdrawals, loans, or used to pay premiums, providing financial flexibility and potential tax advantages.

What is Universal Life Insurance?

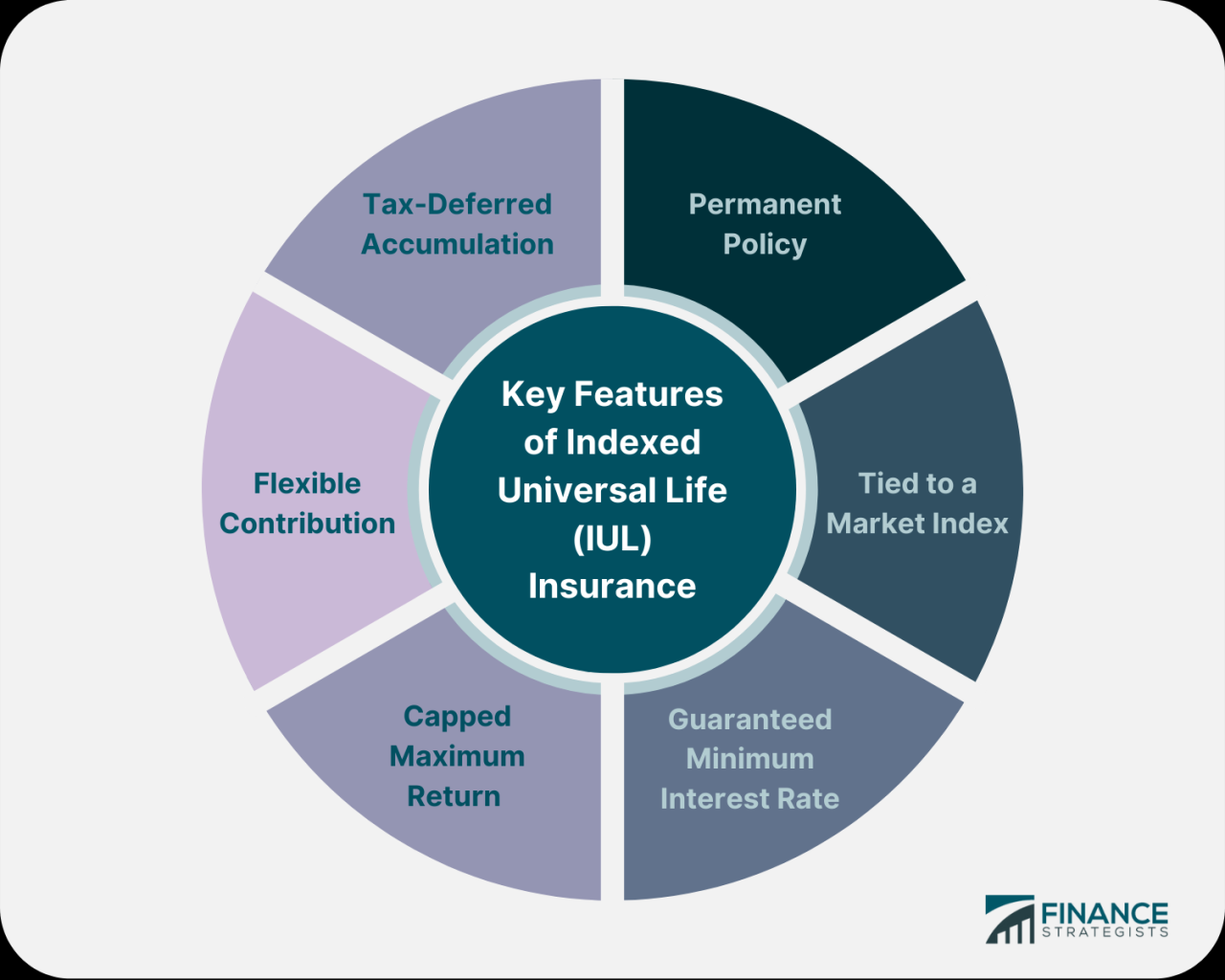

Universal life insurance (UL) is a type of permanent life insurance that offers flexibility in premium payments and death benefit. It combines a death benefit with a cash value component, allowing policyholders to customize their coverage and investment strategies.

Universal Life Insurance Explained

Universal life insurance provides a death benefit, which is a lump sum payment to your beneficiaries upon your death. It also includes a cash value component, which accumulates over time and can be accessed by the policyholder. The cash value component earns interest, typically at a rate that is tied to market performance. This interest can be used to pay premiums, increase the death benefit, or withdrawn for other purposes.

Universal Life Insurance Compared to Other Types

Universal life insurance differs from other types of life insurance in several key ways:

Universal Life Insurance vs. Term Life Insurance

- Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If you die within the term, your beneficiaries receive the death benefit. If you live past the term, the policy expires and you no longer have coverage. Universal life insurance, on the other hand, provides lifelong coverage, as long as premiums are paid.

- Term life insurance is typically more affordable than universal life insurance, especially for younger people. However, term life insurance does not build cash value.

Universal Life Insurance vs. Whole Life Insurance

- Whole life insurance is a type of permanent life insurance that provides lifelong coverage and a guaranteed cash value component. The cash value in whole life insurance grows at a fixed rate, which is typically lower than the rate offered by universal life insurance.

- Universal life insurance offers more flexibility than whole life insurance in terms of premium payments and death benefit adjustments. However, universal life insurance does not guarantee a specific rate of return on the cash value component.

Key Features of Universal Life Insurance

Universal life insurance offers a range of features designed to provide flexibility and customization to meet diverse financial needs. These features, including premium payment options, cash value accumulation, and death benefit choices, contribute to the policy’s adaptability.

Flexible Premium Payment Options

Universal life insurance policies offer flexibility in premium payments, allowing policyholders to adjust their contributions based on their financial circumstances.

- Fixed Premiums: Policyholders can opt for fixed premiums, where they pay a set amount each month. This provides predictability and stability in premium payments.

- Flexible Premiums: Policyholders can choose flexible premiums, allowing them to adjust their payments based on their income or other financial obligations. This option offers greater flexibility but requires careful monitoring to ensure adequate coverage.

- Premium Holidays: Some policies allow policyholders to temporarily suspend premium payments for a specified period. This can be helpful during financial hardship, but it’s crucial to understand the potential impact on coverage.

Cash Value Accumulation

Universal life insurance policies feature a cash value component that accumulates over time. This cash value represents a portion of the premium payments that is invested and grows tax-deferred.

- Investment Options: Policyholders typically have a choice of investment options for their cash value, such as fixed interest accounts or mutual funds. The investment performance directly impacts the growth of the cash value.

- Loan Access: Policyholders can borrow against their cash value at a specified interest rate. This can provide access to funds for various purposes, but it’s important to consider the interest charges and potential impact on death benefits.

- Tax Advantages: The cash value component grows tax-deferred, meaning taxes are not paid until the money is withdrawn. This provides a potential tax advantage compared to other investments.

Death Benefit Options

Universal life insurance policies offer various death benefit options, allowing policyholders to tailor the payout to their specific needs.

- Level Death Benefit: This option provides a fixed death benefit throughout the policy’s term, ensuring a predetermined amount is paid to beneficiaries upon the policyholder’s death.

- Increasing Death Benefit: This option allows the death benefit to increase over time, typically tied to the growth of the cash value component. This can provide greater coverage as the policyholder ages.

- Decreasing Death Benefit: This option provides a death benefit that decreases over time, often used to cover a specific financial obligation that diminishes with time, such as a mortgage.

How Universal Life Insurance Works

Universal life insurance operates differently from traditional life insurance policies. It offers flexibility in premium payments and death benefit adjustments, along with a cash value component that can be accessed for various financial needs.

Calculating Premiums and Death Benefits

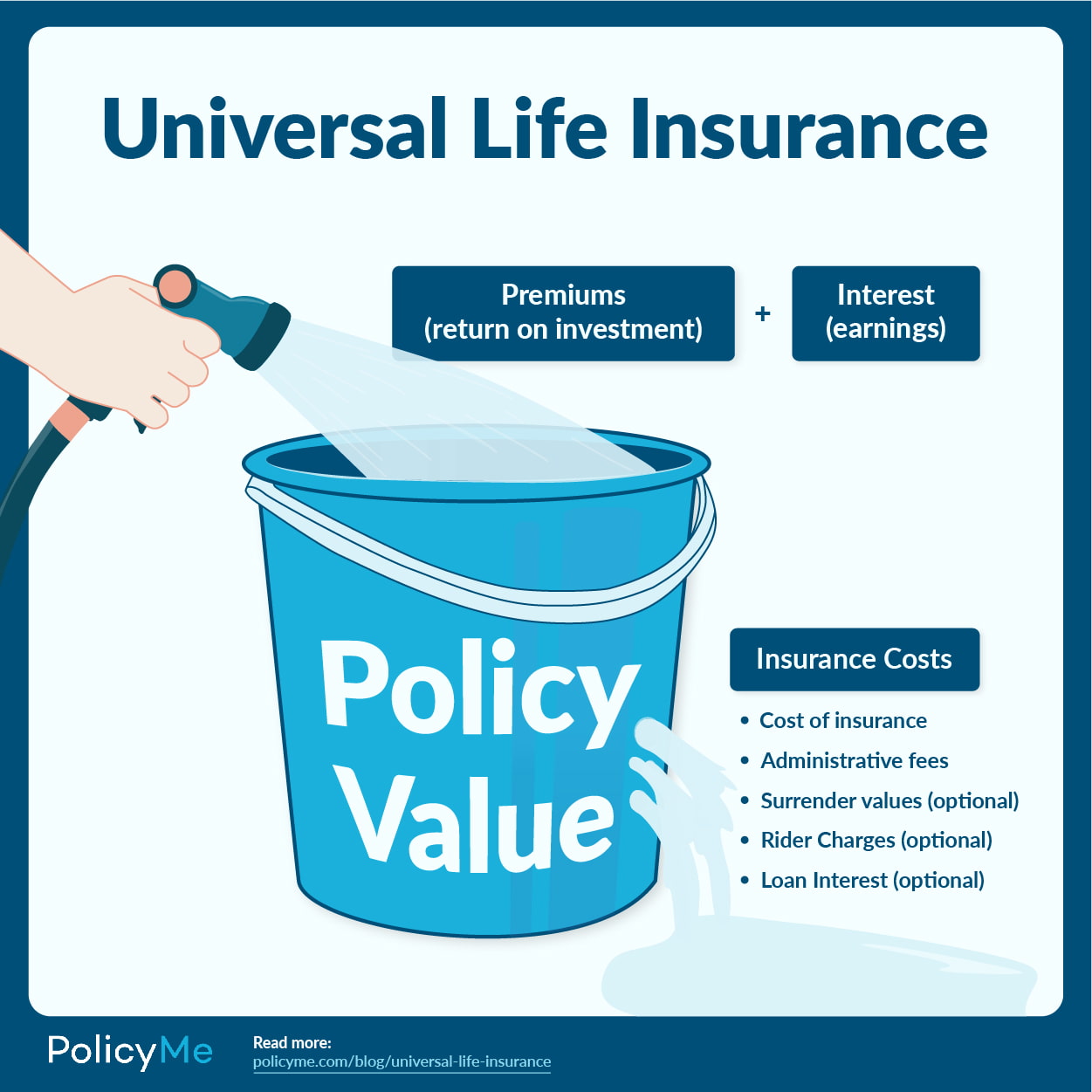

Universal life insurance premiums are calculated based on the policyholder’s age, health, and the desired death benefit. The premium amount is divided into two components: the cost of insurance (COI) and the premium payment for the cash value account. The COI covers the risk of death, and it increases with age. The cash value account accumulates interest based on the policy’s performance, which can vary depending on market conditions.

The death benefit in universal life insurance is flexible and can be adjusted over time. Policyholders can choose to increase or decrease the death benefit, depending on their changing needs. The death benefit can be adjusted independently of the cash value account.

The Cash Value Account

The cash value account in universal life insurance acts like a savings account, accumulating interest and providing access to funds. Policyholders can borrow against the cash value account, withdraw funds, or leave it to grow tax-deferred. The cash value account is funded by a portion of the premium payments and earns interest based on the policy’s performance.

Using the Cash Value

The cash value account can be used for various financial needs, such as:

- Retirement planning: The cash value can serve as a supplemental retirement income source.

- College savings: Policyholders can use the cash value to help pay for their children’s education.

- Emergency funds: The cash value can provide a source of funds for unexpected expenses.

- Debt consolidation: Policyholders can borrow against the cash value to consolidate high-interest debt.

It’s important to note that withdrawals from the cash value account may reduce the death benefit and impact the policy’s overall performance.

Advantages of Universal Life Insurance

Universal life insurance offers a number of advantages that make it an attractive option for many individuals and families. These advantages stem from the flexibility and control it provides over the policy, allowing policyholders to tailor it to their specific needs and circumstances.

Flexibility and Control

Universal life insurance provides policyholders with a significant degree of flexibility and control over their policy. This flexibility allows them to adjust their coverage and premiums to meet their changing needs over time. For instance, a policyholder might increase their death benefit if their family grows or decrease it if their financial obligations decrease. They can also adjust their premium payments to fit their budget.

Tax-Deferred Growth of Cash Value

Universal life insurance policies accumulate cash value that grows tax-deferred. This means that the interest earned on the cash value is not taxed until it is withdrawn. This tax-deferred growth can be a significant advantage, allowing the cash value to accumulate more rapidly than if it were taxed annually.

Ability to Adjust Coverage and Premiums

Universal life insurance policies allow policyholders to adjust their coverage and premiums based on their changing needs. This flexibility is particularly valuable for individuals and families whose circumstances are likely to change over time. For example, a policyholder might increase their death benefit if their family grows or decrease it if their financial obligations decrease. They can also adjust their premium payments to fit their budget.

Disadvantages of Universal Life Insurance

While universal life insurance offers flexibility and potential growth, it’s crucial to acknowledge its potential drawbacks. These disadvantages can impact your financial planning and the overall effectiveness of your policy.

Potential Risks Associated with Universal Life Insurance

Universal life insurance involves certain risks, including the possibility of the policy lapsing. Lapsing occurs when the policyholder fails to make premium payments, resulting in the termination of the policy. This can leave beneficiaries without the intended death benefit and the policyholder without the potential for future cash value growth.

A common reason for policy lapsing is the failure to keep up with premium payments, particularly during periods of financial hardship.

Higher Premiums Compared to Other Types of Life Insurance

Universal life insurance premiums are generally higher compared to other types of life insurance, such as term life insurance. This is due to the added flexibility and investment component associated with universal life policies. The higher premiums can make universal life insurance less affordable for some individuals, especially those on a tight budget.

Complexities and Challenges in Managing a Universal Life Insurance Policy

Universal life insurance policies can be complex to understand and manage. Policyholders need to carefully consider their investment choices within the policy and monitor their account performance. They also need to be aware of potential fees and charges associated with the policy, which can impact the overall return on their investment.

Managing a universal life insurance policy effectively requires a good understanding of financial concepts and investment strategies.

When Universal Life Insurance is a Good Choice

Universal life insurance can be a suitable option for individuals who are looking for a flexible and customizable life insurance policy. It offers features that allow policyholders to adjust their coverage and premiums over time, making it a potentially attractive choice for those with specific financial goals or changing life circumstances.

Individuals Who Might Benefit From Universal Life Insurance

Universal life insurance can be particularly beneficial for individuals with specific financial needs or who are seeking a policy that offers flexibility and control. Here are some examples of individuals who might benefit from universal life insurance:

- Individuals with fluctuating incomes: Universal life insurance allows policyholders to adjust their premiums based on their income, providing flexibility during periods of financial uncertainty. This can be particularly beneficial for self-employed individuals or those with variable income streams.

- Individuals with specific financial goals: Universal life insurance can be used as a tool to accumulate cash value, which can be accessed for various purposes, such as funding retirement, paying for education expenses, or covering unexpected expenses. This flexibility can be valuable for individuals with long-term financial goals.

- Individuals who want to control their investment strategy: Universal life insurance policies often offer a variety of investment options, allowing policyholders to choose how their cash value is invested. This can be attractive for individuals who want to actively manage their investments and potentially earn higher returns.

- Individuals with large estates: Universal life insurance can be used to cover estate taxes, ensuring that a significant portion of the estate is passed on to beneficiaries without being depleted by tax liabilities. This can be particularly beneficial for individuals with substantial wealth.

Factors to Consider When Deciding If Universal Life Insurance is Right for You

While universal life insurance can be a good choice for some individuals, it’s essential to carefully consider its features and potential drawbacks before making a decision. Here are some key factors to consider:

- Your financial goals and risk tolerance: Universal life insurance is a complex product with potential risks. It’s crucial to understand your financial goals and risk tolerance before deciding if this type of policy is suitable for you. Consider your investment experience, time horizon, and willingness to accept potential losses.

- Your budget and premium flexibility: Universal life insurance premiums can vary significantly depending on factors such as age, health, and coverage amount. Ensure that you can afford the premiums and understand the potential for fluctuations over time. Consider your income stability and ability to manage premium adjustments.

- The potential for investment growth: The cash value component of universal life insurance is invested in a variety of options, such as mutual funds or bonds. The potential for investment growth depends on the chosen investment strategy and market conditions. It’s essential to understand the risks associated with investment growth and potential for losses.

- The availability of other life insurance options: Universal life insurance is not the only type of life insurance available. Consider other options, such as term life insurance or whole life insurance, and compare their features, costs, and suitability to your specific needs.

- The complexity of universal life insurance: Universal life insurance policies can be complex and require a thorough understanding of their features and potential risks. Seek professional advice from a qualified financial advisor to ensure that you fully understand the policy terms and conditions before making a decision.

Universal Life Insurance vs. Other Life Insurance Types

Universal life insurance is a type of permanent life insurance that offers flexibility and investment options. However, it’s important to understand how it compares to other life insurance types to determine if it’s the right fit for your needs.

Universal Life Insurance vs. Term Life Insurance

Term life insurance is a temporary type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. Universal life insurance, on the other hand, is a permanent type of life insurance that provides coverage for your entire life. Here’s a comparison of the key differences:

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years. Premiums are generally lower than universal life insurance, making it a more affordable option for younger individuals or those on a tight budget. However, the policy expires at the end of the term, and you won’t receive any cash value.

- Universal Life Insurance: Provides coverage for your entire life. Premiums are generally higher than term life insurance, but you can accumulate cash value that you can borrow against or withdraw.

Universal Life Insurance vs. Whole Life Insurance

Whole life insurance is another type of permanent life insurance that offers lifelong coverage. Here’s a comparison of the key differences:

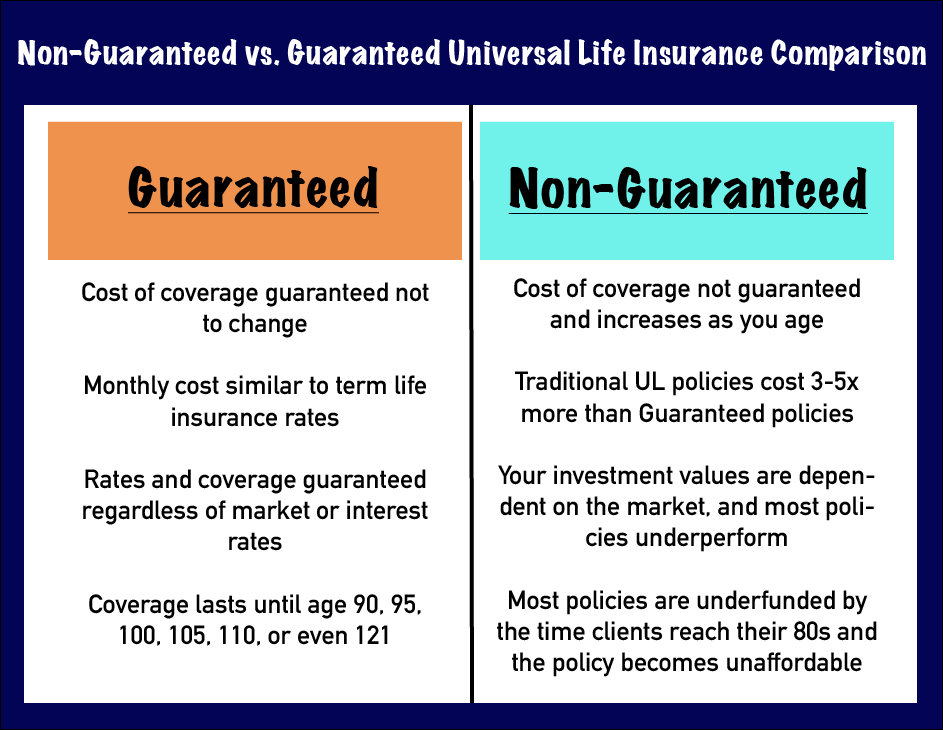

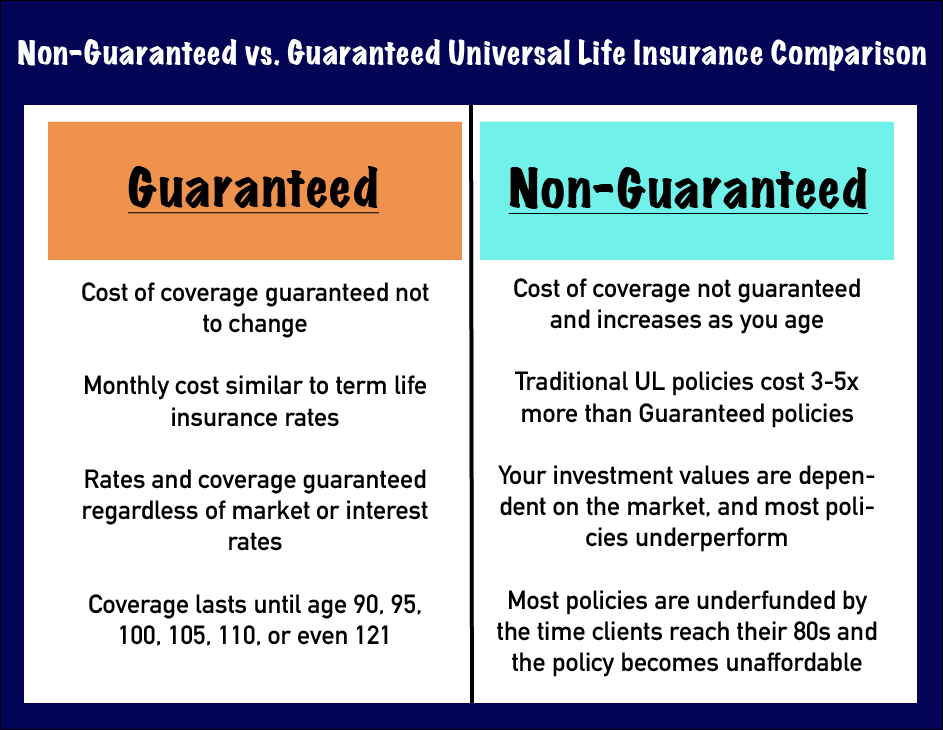

- Universal Life Insurance: Offers more flexibility in terms of premium payments and death benefit. It allows you to adjust your premium payments and death benefit to meet your changing needs. However, it carries a higher risk of policy lapse if you don’t manage your premiums and cash value carefully.

- Whole Life Insurance: Premiums are fixed and guaranteed for life, and the death benefit is also fixed. It offers a guaranteed cash value that grows at a fixed rate, but it generally has lower returns than universal life insurance.

Key Differences Between Life Insurance Types

| Feature | Term Life | Whole Life | Universal Life |

|---|---|---|---|

| Coverage Period | Temporary (10, 20, 30 years) | Lifelong | Lifelong |

| Premiums | Lower | Fixed and guaranteed | Flexible |

| Death Benefit | Fixed | Fixed | Adjustable |

| Cash Value | None | Guaranteed growth at fixed rate | Potentially higher returns, but not guaranteed |

| Flexibility | Limited | Limited | High |

| Risk | Low | Low | Higher (policy lapse) |

Choosing a Universal Life Insurance Policy

Selecting the right universal life insurance policy involves careful consideration of various factors to ensure it aligns with your individual needs and financial goals.

Factors to Consider When Choosing a Universal Life Insurance Policy

- Death Benefit: The death benefit is the amount your beneficiaries will receive upon your death. Determine the appropriate amount based on your family’s financial needs and obligations.

- Premium Payments: Understand the flexibility of premium payments, whether they are fixed or variable. Explore options for adjusting premiums based on your financial situation.

- Cash Value Growth: Assess the potential for cash value growth within the policy. Consider the interest rates offered and the impact of market fluctuations.

- Fees and Expenses: Carefully review the fees associated with the policy, including administrative fees, mortality charges, and surrender charges.

- Policy Riders: Explore the availability of optional riders, such as long-term care riders or accidental death benefit riders, to enhance coverage.

Key Features to Look for in a Universal Life Insurance Policy

- Competitive Interest Rates: Look for policies offering competitive interest rates on the cash value component to maximize growth potential.

- Flexible Premium Payments: Choose a policy that allows for flexible premium payments to adjust to changing financial circumstances.

- Low Fees and Expenses: Opt for policies with transparent and reasonable fees to minimize the impact on cash value growth.

- Transparent Disclosure: Ensure the policy documents provide clear and comprehensive information about the policy’s terms, conditions, and fees.

- Financial Strength of the Insurer: Choose a reputable insurance company with a strong financial rating to ensure the stability and reliability of the policy.

Tips for Finding a Reputable Insurance Provider

- Seek Recommendations: Ask family, friends, and financial advisors for recommendations on reputable insurance providers.

- Check Financial Ratings: Review the financial ratings of potential insurers from organizations like AM Best or Standard & Poor’s.

- Compare Quotes: Obtain quotes from multiple insurers to compare premiums, features, and terms.

- Read Reviews: Research online reviews and testimonials from previous customers to gain insights into the insurer’s reputation and customer service.

- Consult a Financial Advisor: Consider consulting a qualified financial advisor to help you navigate the insurance selection process and make informed decisions.

Universal Life Insurance and Estate Planning

Universal life insurance can be a valuable tool in estate planning, helping to minimize estate taxes and provide financial security for beneficiaries.

Tax Advantages of Universal Life Insurance

Universal life insurance policies can offer several tax advantages when used in estate planning. The death benefit paid out to beneficiaries is generally tax-free, meaning that the proceeds are not subject to income tax. Additionally, the cash value component of the policy can grow tax-deferred, meaning that taxes are not paid on the earnings until the money is withdrawn.

Minimizing Estate Taxes

Universal life insurance can be used to offset estate taxes in several ways:

* Creating a Tax-Free Gift: The cash value of a universal life insurance policy can be used to make tax-free gifts to beneficiaries. This can be particularly advantageous for large estates, as it allows the policyholder to reduce their taxable estate without incurring gift tax.

* Funding a Charitable Legacy: Universal life insurance can be used to fund a charitable foundation or donate to a favorite charity. This can be a tax-efficient way to leave a lasting legacy and reduce the overall size of the estate.

* Using the Death Benefit to Pay Estate Taxes: The death benefit from a universal life insurance policy can be used to pay estate taxes, ensuring that beneficiaries receive the full value of the estate without having to sell assets to cover the tax liability.

Examples of Estate Planning with Universal Life Insurance

* A Business Owner: A business owner with a large estate may use a universal life insurance policy to provide liquidity to the estate in the event of their death. This can help ensure that the business can continue to operate smoothly and that the owner’s family receives the full value of their investment.

* A High-Net-Worth Individual: A high-net-worth individual may use a universal life insurance policy to offset the potential estate tax liability on their assets. This can help ensure that their beneficiaries receive the full value of their estate without having to sell assets to cover the tax liability.

Closing Notes

Universal life insurance can be a valuable tool for individuals seeking flexible and customizable coverage with potential long-term growth. However, it’s essential to understand the complexities and potential risks involved before making a decision. Consulting with a qualified financial advisor can help you determine if universal life insurance is the right choice for your unique financial situation and goals.