Life insurance payout is a critical aspect of financial planning, offering a lifeline to loved ones when you’re gone. It’s more than just a sum of money; it’s a promise of security, a shield against financial hardship, and a testament to the love and care you have for those you leave behind.

Understanding the intricacies of life insurance payout, from the different types available to the factors that influence the amount received, is essential for making informed decisions about your financial future. This guide will explore the various aspects of life insurance payout, demystifying the process and providing insights that can help you navigate this complex topic with confidence.

What is Life Insurance Payout?

A life insurance payout, also known as a death benefit, is a sum of money paid to a beneficiary upon the death of the insured person. It is a financial safety net designed to help loved ones cope with the financial consequences of losing a breadwinner.

Purpose of Life Insurance Payout

The primary purpose of a life insurance payout is to provide financial support to beneficiaries after the insured’s death. This support can help cover various expenses, including:

- Funeral costs and final expenses

- Outstanding debts, such as mortgages, credit card bills, or student loans

- Living expenses for surviving family members

- Educational expenses for children

- Income replacement for a lost breadwinner

Examples of Life Insurance Payout Usage

The specific ways a life insurance payout is used depend on the individual circumstances of the beneficiary and the insured. Here are some common examples:

- A young widow with two children may use the payout to cover living expenses, mortgage payments, and the children’s education.

- An elderly couple may use the payout to cover funeral costs and any outstanding debts.

- A single parent may use the payout to ensure their child’s financial security until they reach adulthood.

Types of Life Insurance Payouts

Life insurance payouts can be structured in various ways, each with its own set of advantages and disadvantages. Understanding these options is crucial for beneficiaries to make informed decisions about how to manage the proceeds.

Lump Sum Payout

A lump sum payout is the most common type of life insurance payout. It involves the beneficiary receiving the entire death benefit in a single payment. This method offers flexibility and control over the funds.

- Advantages:

- Provides immediate access to a large sum of money, allowing beneficiaries to address immediate needs.

- Offers flexibility in how the funds are used, allowing for investment, debt repayment, or other financial goals.

- Disadvantages:

- Can be overwhelming for beneficiaries who may not be financially savvy or accustomed to managing large sums of money.

- The risk of mismanaging or depleting the funds quickly, especially if the beneficiary is not financially disciplined.

Structured Settlement

A structured settlement involves the death benefit being paid out over time in installments. This option provides a steady stream of income for beneficiaries.

- Advantages:

- Provides a regular source of income, ensuring financial stability for beneficiaries.

- Reduces the risk of mismanaging the funds, as the money is received in installments.

- Can be customized to meet specific needs, such as providing income for a certain period or until a child reaches a certain age.

- Disadvantages:

- The total amount received may be less than a lump sum payout due to interest rates and administrative fees.

- Limited flexibility in how the funds are used, as they are received in installments.

Trust Payout

A trust payout involves setting up a trust to manage the death benefit. This option can provide asset protection and tax benefits.

- Advantages:

- Protects the funds from creditors and lawsuits, ensuring that the beneficiaries receive the full amount.

- Can provide tax benefits, as the trust may be structured to minimize taxes on the proceeds.

- Provides professional management of the funds, ensuring that they are invested wisely and used responsibly.

- Disadvantages:

- Can be complex and expensive to set up and manage.

- May require the services of a trust attorney or financial advisor.

Comparison of Payout Types

| Payout Type | Characteristics | Advantages | Disadvantages |

|---|---|---|---|

| Lump Sum | Single payment of the entire death benefit | Flexibility, immediate access to funds | Risk of mismanagement, potential for financial strain |

| Structured Settlement | Installments paid out over time | Regular income, reduced risk of mismanagement | Lower total payout, limited flexibility |

| Trust Payout | Funds managed by a trust | Asset protection, tax benefits, professional management | Complex and expensive to set up, requires specialized expertise |

Factors Affecting Life Insurance Payout Amount

The amount of a life insurance payout is determined by several factors. Understanding these factors is crucial for policyholders to make informed decisions about their life insurance coverage. The payout amount can be influenced by the policy’s terms, the insured’s characteristics, and market conditions.

Policy Type and Coverage

The type of life insurance policy and the coverage amount selected directly impact the payout.

- Term Life Insurance: Provides coverage for a specific period. The payout is typically a lump sum equal to the death benefit, which is determined at the policy’s inception. For example, a $500,000 term life insurance policy will pay out $500,000 upon the insured’s death within the policy term.

- Whole Life Insurance: Offers lifelong coverage with a fixed premium. The payout is typically a lump sum equal to the death benefit, which may be a combination of the cash value accumulated over time and the face value of the policy.

- Universal Life Insurance: Provides flexible premiums and death benefit options. The payout depends on the accumulated cash value and the chosen death benefit amount.

- Variable Life Insurance: Invests premiums in sub-accounts that fluctuate with market performance. The payout depends on the performance of the chosen investments and the death benefit amount.

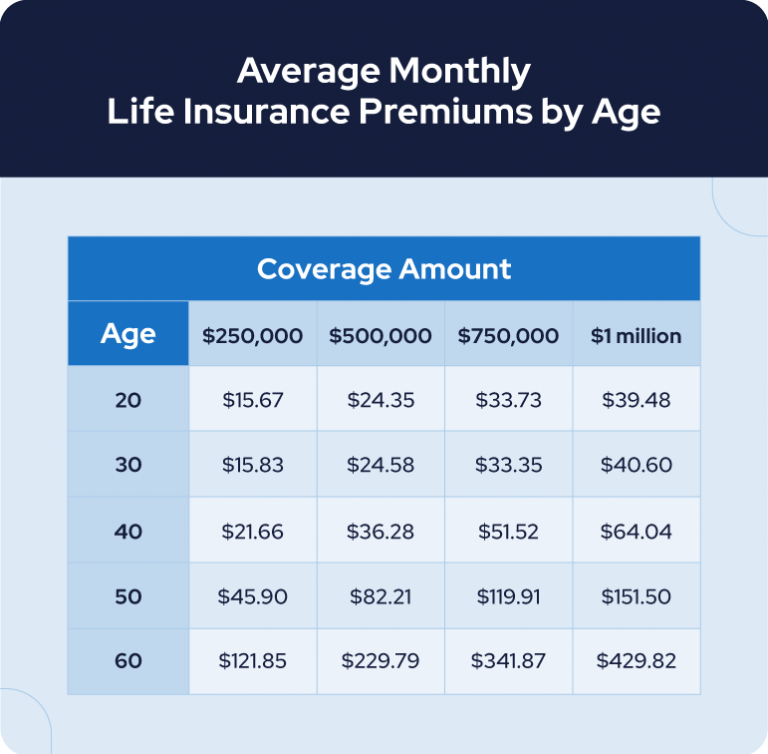

Insured’s Age, Health, and Lifestyle

The insured’s age, health, and lifestyle are significant factors that influence the premium and, indirectly, the payout amount.

- Age: Older individuals generally pay higher premiums for life insurance due to their increased risk of mortality. Consequently, their death benefit may be lower for the same premium amount compared to younger individuals.

- Health: Individuals with pre-existing health conditions or risky lifestyles may face higher premiums and potentially lower death benefits. Life insurance companies assess health risks to determine the likelihood of a claim and adjust premiums accordingly.

- Lifestyle: Individuals engaging in high-risk activities, such as skydiving or professional sports, may face higher premiums and potentially lower death benefits due to their increased risk of mortality.

Market Conditions and Interest Rates

Market conditions and interest rates can impact the growth of cash value in certain types of life insurance, such as whole life and universal life insurance.

- Interest Rates: Higher interest rates generally lead to higher cash value growth, potentially increasing the payout amount. Conversely, lower interest rates can result in slower cash value growth, potentially decreasing the payout amount.

- Inflation: Inflation can erode the purchasing power of the death benefit over time. Life insurance policies may offer features like inflation protection to help mitigate this risk.

The Claims Process

The life insurance claims process is the procedure for receiving the death benefit from the policy after the insured person passes away. This process involves notifying the insurance company, providing necessary documentation, and waiting for the claim to be reviewed and approved.

Steps Involved in Filing a Life Insurance Claim

The process of filing a life insurance claim involves several steps. Here’s a general overview:

- Notify the Insurance Company: The first step is to contact the insurance company and report the death of the insured person. This can usually be done by phone, email, or online. The insurance company will provide you with instructions on how to proceed with the claim.

- Gather Necessary Documentation: You will need to provide the insurance company with specific documents to support your claim. These may include the death certificate, proof of the insured’s identity, and the original life insurance policy.

- Complete Claim Forms: The insurance company will provide you with claim forms to complete. These forms will ask for details about the insured person, the beneficiaries, and the cause of death.

- Submit the Claim: Once you have completed all the necessary documentation, you can submit your claim to the insurance company. You can do this by mail, fax, or online.

- Claim Review and Approval: The insurance company will review your claim and verify the information you provided. This process may take several weeks or even months, depending on the complexity of the claim.

- Payment of Death Benefit: Once the claim is approved, the insurance company will pay the death benefit to the named beneficiaries. The payment can be made by check, direct deposit, or other methods.

Documentation Required for a Life Insurance Claim

The documentation required for a life insurance claim will vary depending on the insurance company and the specific policy. However, some common documents include:

- Death Certificate: This is a legal document that verifies the death of the insured person. It should be obtained from the relevant government agency or medical examiner.

- Proof of Identity: You will need to provide documentation that proves the identity of the deceased. This may include a driver’s license, passport, or birth certificate.

- Original Life Insurance Policy: The original policy document will contain the policy details, including the death benefit amount, the beneficiary information, and the policy terms and conditions.

- Beneficiary Information: You will need to provide the insurance company with the names and addresses of the beneficiaries. This information can be found on the policy document.

- Proof of Relationship: You may need to provide documentation that proves your relationship to the deceased. This may include a marriage certificate, birth certificate, or adoption papers.

- Autopsy Report: If the cause of death was not immediately clear, the insurance company may request an autopsy report to determine the cause of death.

- Police Report: If the death was accidental or suspicious, the insurance company may request a police report.

Tips for Ensuring a Smooth Claims Process

Here are some tips to help ensure a smooth claims process:

- Keep Your Policy Information Up-to-Date: Ensure that the insurance company has your current contact information and that the beneficiary information is accurate.

- Notify the Insurance Company Promptly: Contact the insurance company as soon as possible after the death of the insured person. This will help expedite the claims process.

- Gather All Required Documentation: Make sure you have all the necessary documentation before submitting your claim. This will help avoid delays.

- Be Patient and Cooperative: The claims process can take some time, so be patient and cooperate with the insurance company.

- Seek Professional Advice: If you are unsure about any aspect of the claims process, seek advice from a lawyer or financial advisor.

Tax Implications of Life Insurance Payouts

Life insurance payouts are generally not subject to federal income tax. This means that the beneficiary receiving the death benefit does not have to report it as income on their tax return. However, there are some exceptions to this rule, and certain situations may lead to tax implications on life insurance payouts.

Taxable Life Insurance Payouts

There are several situations where life insurance payouts may be subject to taxation.

- Life Insurance Proceeds Used for Business Purposes: If the death benefit is used to fund a business or purchase business assets, it may be considered taxable income.

- Transfer for Value: If the policy is sold or transferred to another person for a sum greater than the premiums paid, the proceeds may be subject to taxation.

- Interest Earned on Policy Proceeds: If the beneficiary chooses to leave the death benefit with the insurance company and earn interest on it, the interest earned may be subject to taxation.

- Accelerated Death Benefits: In certain cases, individuals with terminal illnesses may receive a portion of their death benefit before they die. This early payout may be subject to taxation depending on the circumstances.

Taxation of Life Insurance Payouts

The taxability of life insurance payouts depends on several factors, including the type of policy, the beneficiary, and how the proceeds are used.

- Life Insurance Policy Type: The type of life insurance policy can affect the tax implications. For example, certain types of policies, such as universal life insurance, may be subject to taxation on the interest earned.

- Beneficiary: The beneficiary of the policy can also impact the taxability of the payout. If the beneficiary is a charity, the death benefit may be tax-free. However, if the beneficiary is an individual, the proceeds may be subject to taxation in certain situations.

- Use of Proceeds: The way the beneficiary uses the death benefit can also affect the taxability. If the proceeds are used for personal expenses, they are generally tax-free. However, if the proceeds are used for business purposes, they may be considered taxable income.

Example of Taxable Life Insurance Payout

Consider a situation where a business owner has a life insurance policy with a death benefit of $1 million. Upon the owner’s death, the business uses the death benefit to purchase a new piece of equipment. In this case, the $1 million death benefit may be considered taxable income to the business.

Life Insurance Payout Alternatives

Life insurance payouts provide a lump sum of money to beneficiaries upon the insured’s death. However, there are alternatives to traditional life insurance payouts that can provide financial security and meet specific needs. These alternatives offer different structures and benefits, allowing beneficiaries to choose the option that best suits their circumstances.

Annuities

Annuities are financial products that provide a stream of income payments over a set period. They can be purchased with a lump sum payment, such as a life insurance payout, and can be structured to provide income for a specific period, for life, or for a combination of both.

Annuities offer a guaranteed income stream, providing financial stability and protection against market fluctuations. They are particularly beneficial for individuals who prefer a predictable income source rather than a lump sum. Annuities can be structured to meet various needs, such as providing income for retirement, covering living expenses, or paying for long-term care.

Annuities can be a good option for beneficiaries who want to avoid the risk of managing a large sum of money or who need a reliable income stream.

Trusts

A trust is a legal entity that holds assets on behalf of beneficiaries. It can be established during the insured’s lifetime or upon their death, and it allows for the distribution of assets according to the terms specified in the trust agreement.

Trusts offer flexibility and control over how assets are managed and distributed. They can be used to protect assets from creditors, minimize taxes, or ensure that assets are distributed according to the insured’s wishes.

Trusts can be customized to meet specific needs, such as providing for minor children, supporting a disabled beneficiary, or managing assets for charitable purposes.

Comparison of Alternatives

| Feature | Life Insurance Payout | Annuity | Trust |

|—|—|—|—|

| Structure | Lump sum payment | Stream of income payments | Asset holding entity |

| Risk | Beneficiaries manage the funds | Guaranteed income stream | Dependent on trust terms |

| Flexibility | Limited flexibility | Structured income stream | Customizable distribution |

| Tax Implications | Tax-free if proceeds are paid as a death benefit | Tax implications vary based on type of annuity | Tax implications depend on trust structure |

Factors to Consider

When choosing between life insurance payout alternatives, consider factors such as:

* Beneficiary’s needs: What are the beneficiary’s financial goals and circumstances?

* Risk tolerance: How comfortable are the beneficiaries with managing a large sum of money?

* Time horizon: How long will the funds need to last?

* Tax implications: How will the chosen alternative impact the beneficiaries’ tax liability?

* Control and flexibility: How much control do the beneficiaries want over the assets?

Choosing the right alternative depends on the individual circumstances and preferences of the beneficiaries. Consulting with a financial advisor can help determine the best option to meet their needs and goals.

Importance of Life Insurance Planning

Life insurance planning is a crucial aspect of financial planning, particularly for individuals with dependents. It provides a safety net for loved ones in the event of an unexpected death, ensuring their financial stability and well-being.

Financial Security for Dependents

Life insurance plays a vital role in securing the financial future of dependents by providing a lump sum payment upon the policyholder’s death. This payment can be used to cover various expenses, including:

- Mortgage payments

- Living expenses

- Education costs

- Debt repayment

- Funeral expenses

Without life insurance, dependents may face significant financial strain, potentially jeopardizing their quality of life.

Creating a Comprehensive Life Insurance Plan

A comprehensive life insurance plan should consider various factors to ensure adequate coverage:

- Determine Coverage Needs: Calculate the amount of coverage needed based on dependents’ financial requirements and outstanding debts. Factors like mortgage payments, education costs, and living expenses should be considered.

- Choose the Right Policy Type: Different types of life insurance policies cater to specific needs. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage and investment features.

- Review and Adjust Coverage: Regularly review and adjust coverage as life circumstances change. Factors like the birth of a child, changes in income, or increased debt may necessitate coverage adjustments.

- Consider Beneficiary Designations: Carefully designate beneficiaries to ensure the death benefit is distributed according to your wishes. Consider the financial needs and legal capacity of each beneficiary.

Life Insurance Payout in Different Situations

Life insurance payouts are typically made upon the death of the insured individual, but the specific circumstances surrounding the death can significantly impact the payout process and amount. Different situations, such as death by accident, suicide, or illness, come with their own legal and ethical considerations. This section explores how life insurance payouts are handled in various scenarios, providing insights into the complexities involved.

Death by Accident

When an insured individual dies due to an accident, the beneficiary is generally entitled to receive the full death benefit. However, the insurance company may conduct a thorough investigation to ensure that the death was indeed accidental and not a result of any pre-existing conditions or intentional acts. If the investigation reveals that the death was caused by a pre-existing condition or intentional act, the insurance company may deny the claim or reduce the payout.

For example, if a person with a history of heart problems dies in a car accident, the insurance company might investigate whether the accident was a direct result of the heart condition. If it’s determined that the heart condition contributed to the accident, the payout could be reduced or denied.

Death by Suicide

Suicide is a sensitive and complex issue that can raise legal and ethical challenges in the context of life insurance payouts. Many life insurance policies have a suicide exclusion clause, which states that the death benefit will not be paid if the insured commits suicide within a certain period, typically two years, from the policy’s inception.

The purpose of this clause is to prevent individuals from taking out life insurance policies solely to profit from their own death.

If the insured commits suicide after the exclusion period, the beneficiary may still be eligible for the full death benefit. However, the insurance company may require additional documentation, such as a coroner’s report, to confirm the cause of death.

Death by Illness

Death due to illness is the most common reason for life insurance payouts. In such cases, the beneficiary typically receives the full death benefit, provided the policy is in good standing and the cause of death is not excluded from coverage. The insurance company may require a death certificate and other medical records to verify the cause of death.

For instance, if an insured individual dies from cancer, the insurance company will typically review medical records to confirm the diagnosis and ensure that the cancer was not pre-existing and excluded from coverage.

Common Misconceptions About Life Insurance Payouts

Life insurance is a crucial financial tool, yet many misconceptions surrounding its payouts can lead to confusion and potentially detrimental decisions. Understanding the realities behind these misconceptions is essential for making informed choices about your life insurance coverage.

The Payout Is Always Taxable

A common misconception is that all life insurance payouts are subject to income tax. While this may be true for certain types of policies, such as employer-provided group life insurance, most individual life insurance policies are designed to provide tax-free death benefits. This means the beneficiary receiving the payout will not have to pay federal income tax on the money.

The Internal Revenue Code (IRC) Section 101(a) states that proceeds received from a life insurance policy are generally not included in the gross income of the beneficiary.

However, it’s important to note that interest earned on the death benefit, if any, may be subject to taxation.

The Beneficiary Can Use the Payout for Anything

While beneficiaries have complete discretion over how they use the death benefit, it’s crucial to understand that the funds should primarily be used to address financial obligations and ensure the beneficiary’s financial stability.

For instance, if the insured had outstanding debts like a mortgage or credit card balances, the beneficiary might use the payout to clear these obligations. This helps prevent the family from facing financial distress after the insured’s passing.

The Policy Is Always Worth the Same Amount as the Premium Paid

This misconception is based on the idea that the policy is a form of savings account. However, life insurance is fundamentally a risk management tool, not an investment. The death benefit is not directly tied to the amount of premiums paid but is determined by factors like the insured’s age, health, and the coverage amount chosen.

The premiums paid contribute to the policy’s cash value, which may grow over time. However, the death benefit is typically based on the coverage amount selected at the time of policy purchase, not the cumulative premium payments.

The Payout Is Always Available Immediately

While life insurance payouts are designed to provide financial support promptly, the actual disbursement process can take some time.

The beneficiary will typically need to submit a claim and provide documentation, such as a death certificate, to verify the insured’s passing.

The insurer will then review the claim and process the payout, which can take several weeks or even months depending on the complexity of the claim and the insurer’s procedures.

The Payout Is Always Enough to Cover All Expenses

It’s crucial to understand that life insurance payouts are not a guaranteed solution to all financial challenges.

The death benefit is meant to provide financial security, but it’s essential to determine the appropriate coverage amount based on individual needs and circumstances.

A thorough financial analysis considering factors like outstanding debts, dependents’ living expenses, and future financial goals is essential to determine the right amount of life insurance coverage.

The Policy Is Always Worth the Same Amount Throughout Its Term

Life insurance policies often have a specific term or duration.

During this period, the death benefit remains constant, but the policy’s value may fluctuate based on factors like investment performance or policy adjustments.

For example, in a whole life insurance policy, the death benefit remains fixed, but the cash value, which represents the policy’s accumulated savings, can fluctuate based on investment performance.

The Payout Is Only for the Primary Beneficiary

Many life insurance policies allow for multiple beneficiaries, including primary and contingent beneficiaries.

In case the primary beneficiary predeceases the insured, the contingent beneficiary will receive the payout.

It’s crucial to review the policy’s beneficiary designations and update them as needed to ensure the intended recipients receive the death benefit.

The Payout Is Only for the Insured’s Family

While life insurance payouts are often used to support family members, the beneficiary can be anyone designated by the insured.

This could include friends, charities, or even businesses.

The insured has the flexibility to choose the beneficiary based on their personal wishes and financial objectives.

The Policy Is Always Guaranteed to Pay Out

While life insurance policies are designed to provide financial security, there are certain conditions that may affect the payout.

For example, if the insured engages in high-risk activities or provides false information on the application, the insurer may deny the claim.

It’s important to understand the policy’s terms and conditions, including any exclusions or limitations, to ensure the death benefit will be paid out as intended.

Conclusion

Navigating the world of life insurance payouts requires a thorough understanding of the process, the various options available, and the potential implications. By equipping yourself with the knowledge and tools to make informed decisions, you can ensure that your loved ones are financially protected and secure in the event of your passing. Remember, life insurance is a powerful tool for securing your family’s future, and understanding its nuances can make all the difference in ensuring their financial well-being.