Employer-sponsored health insurance is a cornerstone of the American workforce, providing millions of employees with access to essential healthcare benefits. But with a myriad of plan options, ever-evolving regulations, and rising costs, navigating this complex landscape can be daunting for both employers and employees alike. This comprehensive guide delves into the intricacies of employer health insurance, exploring everything from the basics of plan types to the latest trends in cost management and employee well-being.

From understanding the differences between HMOs and PPOs to navigating the complexities of deductibles and copayments, this guide provides a clear and concise overview of the key considerations for both employers and employees. We’ll examine the factors that influence employer decisions, the strategies for cost containment, and the importance of employee education in maximizing health insurance benefits.

Employer Health Insurance Basics

Employer-sponsored health insurance is a common benefit offered by many companies to their employees. This type of insurance can provide coverage for a wide range of healthcare needs, including medical, dental, vision, and prescription drugs. Understanding the different types of plans available, the key features, and how premiums are calculated can help employees make informed decisions about their health insurance coverage.

Types of Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans are offered in various forms, each with its own set of features and cost structures. The most common types of plans include:

- Health Maintenance Organization (HMO): HMOs typically have a lower monthly premium compared to other plans, but they require members to choose a primary care physician (PCP) within the network. Members must get referrals from their PCP to see specialists or receive other services.

- Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs, allowing members to see any doctor or specialist within or outside the network. However, out-of-network services typically come with higher copayments and deductibles.

- Exclusive Provider Organization (EPO): EPOs are similar to HMOs in that they require members to choose a PCP within the network. However, unlike HMOs, EPOs do not cover out-of-network services at all.

- Point-of-Service (POS): POS plans combine features of both HMOs and PPOs. They allow members to see doctors within the network without a referral but also offer limited coverage for out-of-network services.

Key Features and Benefits of Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans typically provide coverage for a wide range of healthcare needs, including:

- Medical Coverage: This includes coverage for doctor visits, hospital stays, surgeries, and other medical procedures.

- Dental Coverage: Dental insurance covers preventive care, such as cleanings and checkups, as well as restorative procedures, such as fillings and crowns.

- Vision Coverage: Vision insurance covers eye exams, eyeglasses, and contact lenses.

- Prescription Drug Coverage: Prescription drug coverage helps pay for medications prescribed by a doctor.

Employer and Employee Contributions to Premiums

Employer-sponsored health insurance premiums are typically shared between the employer and the employee. The employer’s contribution is often a fixed amount, while the employee’s contribution is usually calculated as a percentage of the total premium.

The specific breakdown of employer and employee contributions can vary widely depending on the company’s size, industry, and location.

Factors Influencing Employer Health Insurance Decisions

Employers face a complex decision-making process when selecting health insurance plans for their employees. This decision is influenced by a multitude of factors, including cost, coverage, employee demographics, and industry trends.

Cost Considerations

Cost is a primary concern for employers when choosing health insurance. Employers need to balance the cost of premiums with the need to provide competitive benefits to attract and retain employees. Employers often consider the following cost factors:

- Premium Costs: Premiums are the monthly payments employers make to insurance carriers for coverage. These costs can vary significantly depending on factors such as the size of the workforce, the type of plan, and the geographic location.

- Deductibles: Deductibles are the amount employees pay out-of-pocket before insurance coverage kicks in. Employers may consider offering plans with higher deductibles to reduce premiums, but this can lead to higher out-of-pocket costs for employees.

- Co-pays and Co-insurance: Co-pays are fixed amounts employees pay for specific services, while co-insurance is a percentage of the cost that employees pay after the deductible is met. These cost-sharing provisions can impact the affordability of healthcare for employees.

- Administrative Costs: Employers incur administrative costs associated with managing their health insurance plans, such as payroll deductions, claims processing, and employee support services. These costs can vary depending on the complexity of the plan and the level of administrative support provided by the insurance carrier.

Coverage Considerations

Employers must carefully evaluate the coverage offered by different health insurance plans to ensure they meet the needs of their employees. Key coverage considerations include:

- Network Size: A larger network provides employees with more choices for healthcare providers. Employers may consider plans with broad networks that include specialists and hospitals in their geographic area.

- Prescription Drug Coverage: Prescription drug coverage is an essential component of health insurance, and employers need to assess the formulary (list of covered drugs) and the co-pay structure for prescription medications.

- Mental Health and Substance Abuse Coverage: Employers may consider plans that offer comprehensive coverage for mental health and substance abuse services, as these conditions can have a significant impact on employee well-being and productivity.

- Wellness Programs: Employers may choose plans that offer wellness programs, such as fitness incentives or health screenings, to promote employee health and reduce healthcare costs.

Employee Demographics

Employers must consider the demographics of their workforce when selecting health insurance plans. Factors such as age, gender, and health status can influence the cost and coverage needs of employees.

- Age: Older employees tend to have higher healthcare costs due to increased risk of chronic conditions. Employers may consider offering plans with higher premiums but broader coverage to meet the needs of older employees.

- Gender: Women generally have higher healthcare costs than men due to factors such as pregnancy and childbirth. Employers may consider offering plans that provide comprehensive coverage for women’s health services.

- Health Status: Employees with pre-existing conditions may have higher healthcare costs. Employers may consider offering plans that provide coverage for pre-existing conditions to ensure equitable access to care.

Industry Trends

Employers should stay informed about industry trends in health insurance to make informed decisions. Trends such as the increasing cost of healthcare, the rise of consumer-driven health plans, and the growing importance of employee well-being can impact health insurance choices.

- Consumer-Driven Health Plans: These plans offer employees more control over their healthcare spending, but they also require them to take on more financial responsibility. Employers may consider offering consumer-driven plans to promote cost-consciousness among employees.

- Wellness Programs: Wellness programs are becoming increasingly popular as employers seek to improve employee health and reduce healthcare costs. Employers may consider offering plans that include wellness programs to encourage healthy behaviors.

- Telemedicine: Telemedicine is the use of technology to provide healthcare services remotely. Employers may consider offering plans that include telemedicine services to provide employees with convenient and affordable access to care.

Government Regulations

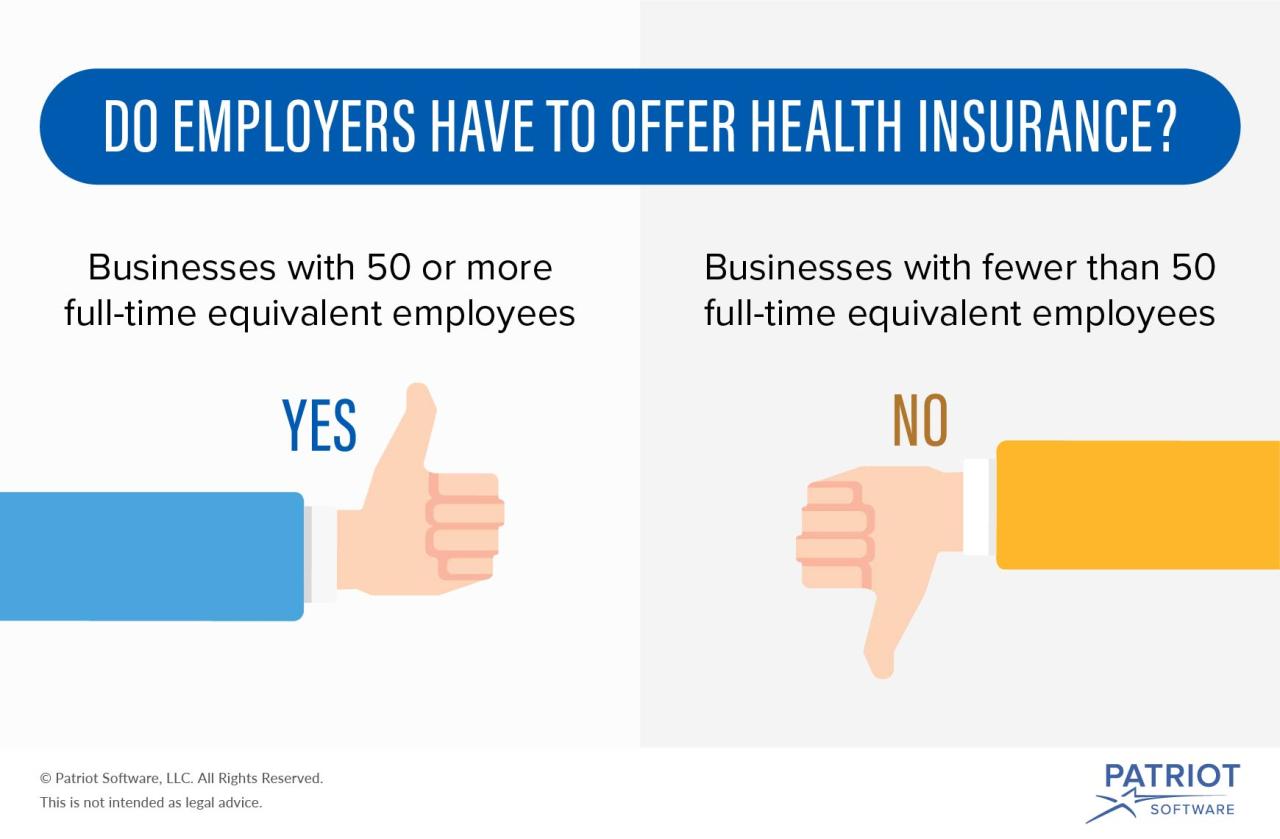

Government regulations, such as the Affordable Care Act (ACA), have a significant impact on employer health insurance decisions. The ACA requires employers with 50 or more full-time equivalent employees to offer health insurance or face penalties.

- ACA Requirements: The ACA requires employers to offer plans that meet certain minimum essential coverage standards. These standards include coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs.

- Premium Tax Credits: The ACA provides premium tax credits to eligible individuals and families to help them afford health insurance. Employers may consider offering plans that qualify for premium tax credits to make coverage more affordable for employees.

- Marketplaces: The ACA established health insurance marketplaces where individuals and families can shop for and purchase health insurance plans. Employers may consider offering plans that are available on the marketplace to provide employees with more options.

Types of Health Insurance Plans

Employers have a range of health insurance plans to choose from, each with its own pros and cons. Common types of plans include:

- Traditional Health Insurance: These plans offer comprehensive coverage with a wide network of providers. However, they can be expensive and may require high deductibles.

- Health Maintenance Organizations (HMOs): HMOs provide coverage through a network of providers. They typically have lower premiums but may have limited out-of-network coverage.

- Preferred Provider Organizations (PPOs): PPOs offer coverage through a network of providers, but they also allow employees to seek care outside the network at a higher cost. PPOs typically have higher premiums than HMOs but offer more flexibility.

- Consumer-Driven Health Plans (CDHPs): CDHPs include high-deductible health plans (HDHPs) and health savings accounts (HSAs). HDHPs have lower premiums but require employees to pay a high deductible before coverage kicks in. HSAs allow employees to save pre-tax dollars for healthcare expenses.

Employee Considerations in Employer Health Insurance

Navigating employer-sponsored health insurance can feel overwhelming, but understanding the different plan options and making informed choices is crucial for employees’ financial well-being and healthcare access. Employees should actively engage in the process to ensure they select a plan that best meets their individual needs and budget.

Understanding Health Insurance Plans

Different types of health insurance plans offered by employers come with varying levels of coverage, cost-sharing, and network restrictions. Understanding these differences is essential for employees to make informed decisions about their healthcare.

- Health Maintenance Organizations (HMOs) typically offer lower premiums but restrict coverage to a specific network of providers.

- Preferred Provider Organizations (PPOs) provide greater flexibility with wider networks but usually have higher premiums.

- Point-of-Service (POS) plans combine elements of HMOs and PPOs, allowing access to both in-network and out-of-network providers with varying levels of cost-sharing.

- High Deductible Health Plans (HDHPs) have lower premiums but require higher out-of-pocket expenses before coverage kicks in. These plans are often paired with Health Savings Accounts (HSAs), allowing pre-tax contributions for healthcare expenses.

Factors to Consider When Choosing a Plan

When selecting a health insurance plan, employees should carefully consider the following factors:

- Coverage: The plan’s coverage should align with the employee’s individual healthcare needs, including prescription drugs, mental health services, and preventive care.

- Deductible: The deductible is the amount an employee must pay out-of-pocket before the insurance plan starts covering expenses.

- Copayments: Copayments are fixed amounts paid for each medical service, such as doctor visits or prescriptions.

- Out-of-Pocket Maximum: This is the maximum amount an employee will pay for healthcare expenses in a given year.

- Network: The plan’s network determines which doctors, hospitals, and other healthcare providers are covered.

Maximizing Employer-Sponsored Health Insurance Benefits

Employees can maximize the benefits of their employer-sponsored health insurance by taking advantage of the following:

- Preventive Care Services: Most health insurance plans cover preventive care services, such as annual checkups, vaccinations, and screenings, at no cost.

- Flexible Spending Accounts (FSAs): FSAs allow employees to set aside pre-tax money to pay for eligible healthcare expenses, including deductibles, copayments, and prescription drugs.

- Negotiating Rates: If an employee is receiving care from an out-of-network provider, they may be able to negotiate lower rates by explaining their insurance coverage.

Trends in Employer Health Insurance

The landscape of employer-sponsored health insurance is constantly evolving, driven by factors such as rising healthcare costs, changing demographics, and technological advancements. These trends have a significant impact on both employers and employees, shaping the way health insurance is designed, delivered, and consumed.

The Rise of High-Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs)

HDHPs, characterized by higher deductibles and lower monthly premiums, have gained popularity in recent years, particularly among employers seeking to control healthcare costs. Coupled with HSAs, which allow individuals to save pre-tax dollars for healthcare expenses, HDHPs offer a cost-effective approach to managing healthcare finances.

“The number of Americans enrolled in HDHPs has increased significantly in recent years, driven by rising healthcare costs and the desire for lower premiums.” – Kaiser Family Foundation

- Lower Premiums: HDHPs typically have lower monthly premiums compared to traditional health plans, making them attractive to employers seeking to reduce their healthcare expenses.

- Cost-Sharing: Individuals with HDHPs bear a greater share of their healthcare costs through higher deductibles. However, this can encourage more responsible healthcare utilization.

- Health Savings Accounts (HSAs): HSAs allow individuals to save pre-tax dollars for healthcare expenses, providing tax advantages and potential long-term savings.

The Impact of Telehealth and Virtual Care

Telehealth and virtual care have emerged as transformative forces in the healthcare industry, offering convenience, accessibility, and cost savings. Employers are increasingly incorporating telehealth options into their health insurance plans, providing employees with greater flexibility and access to care.

- Increased Accessibility: Telehealth eliminates geographical barriers, allowing employees to access care from the comfort of their homes or offices, regardless of their location.

- Convenience: Virtual care appointments often require less time and effort compared to traditional in-person visits, freeing up employees’ schedules.

- Cost Savings: Telehealth services can be more cost-effective for both employers and employees, potentially reducing the need for expensive in-person visits.

The Role of Technology in Managing and Improving Employer Health Insurance Programs

Technology plays a crucial role in modernizing and improving employer health insurance programs. From online portals to mobile apps and data analytics, technology is empowering employers and employees to manage their healthcare needs more effectively.

- Online Portals: Employer-sponsored health insurance portals provide employees with access to their benefits information, claims history, and other relevant details.

- Mobile Apps: Mobile apps enhance the convenience and accessibility of health insurance programs, allowing employees to access their benefits, schedule appointments, and manage their healthcare needs on the go.

- Data Analytics: Data analytics tools help employers identify trends, analyze healthcare utilization patterns, and develop strategies to optimize their health insurance programs.

Cost Management in Employer Health Insurance

Controlling healthcare expenses is a significant challenge for employers, as rising costs can strain budgets and impact profitability. To effectively manage these costs, employers are increasingly implementing strategies that promote cost-conscious healthcare utilization and improve overall health outcomes. These strategies can range from proactive wellness programs to innovative cost-sharing models, each contributing to a more sustainable and efficient healthcare system.

Wellness Programs

Employee wellness programs are a key component of cost management in employer health insurance. These programs aim to improve employee health and well-being, leading to reduced healthcare utilization and lower overall costs.

- Health Education and Screening: These programs offer employees information and resources on various health topics, such as nutrition, physical activity, stress management, and preventive screenings. For example, an employer might offer educational workshops on healthy eating habits or provide on-site screenings for blood pressure, cholesterol, and diabetes.

- Fitness and Activity Incentives: Many employers offer incentives to encourage employees to engage in regular physical activity. This might include subsidized gym memberships, on-site fitness centers, or rewards for participating in fitness challenges.

- Tobacco Cessation Programs: Smoking is a major risk factor for many chronic diseases, so employers often offer programs to help employees quit smoking. These programs might include counseling, medication, and support groups.

- Employee Assistance Programs (EAPs): EAPs provide confidential counseling and support services for employees dealing with personal or work-related issues, such as stress, anxiety, or substance abuse. Addressing these issues can improve mental and emotional well-being, leading to better overall health.

The benefits of employee wellness programs extend beyond cost savings. They can also improve employee morale, reduce absenteeism, and enhance productivity. A study by the National Business Group on Health found that for every $1 spent on wellness programs, employers can save $3.27 in healthcare costs.

Disease Management Programs

Disease management programs are designed to proactively manage chronic conditions, such as diabetes, heart disease, and asthma. By providing early intervention and ongoing support, these programs can help prevent complications, reduce hospitalizations, and lower overall healthcare costs.

- Case Management: Case managers work with individuals with chronic conditions to coordinate their care, ensuring they receive appropriate treatment and support. They may help patients navigate the healthcare system, schedule appointments, and understand their medications.

- Medication Management: These programs help patients manage their medications effectively, ensuring they take the right dosage at the right time and minimize potential side effects.

- Self-Management Education: Patients are educated on how to manage their conditions effectively, including healthy lifestyle choices, medication adherence, and monitoring their symptoms.

By providing comprehensive support and education, disease management programs empower individuals to take control of their health and reduce the burden of chronic conditions.

Prescription Drug Management

Prescription drug costs are a significant expense for employers. Implementing strategies to manage these costs can lead to significant savings.

- Formulary Management: Employers work with their health insurance carriers to develop a formulary, a list of approved medications. This helps ensure that employees are prescribed medications that are both effective and cost-effective.

- Prior Authorization: For certain medications, employers may require prior authorization from a physician before the medication is dispensed. This helps prevent unnecessary or inappropriate prescriptions.

- Generic Substitution: Encouraging the use of generic medications when available can significantly reduce drug costs.

- Mail-Order Pharmacy Programs: Mail-order programs can often provide lower drug prices than traditional retail pharmacies.

By implementing these strategies, employers can ensure that employees have access to the medications they need while also managing prescription drug costs effectively.

Employer Health Insurance and Employee Well-being

Employer-sponsored health insurance plays a crucial role in shaping employee well-being, influencing their health, productivity, and job satisfaction. By providing comprehensive health coverage, employers can create a healthier and more engaged workforce, ultimately contributing to their business success.

The Impact of Employer Health Insurance on Employee Well-being

A strong correlation exists between employer-provided health insurance and employee well-being. Access to quality healthcare can significantly improve employee health outcomes, leading to reduced absenteeism, improved productivity, and enhanced job satisfaction.

Employees with access to comprehensive health insurance are more likely to seek preventive care, manage chronic conditions effectively, and receive timely treatment for acute illnesses.

This proactive approach to healthcare translates into fewer sick days, lower healthcare costs, and a more engaged and productive workforce.

The Importance of Comprehensive Health Insurance Coverage

Comprehensive health insurance coverage is essential for promoting employee well-being. It ensures that employees have access to a wide range of healthcare services, including preventive care, treatment for chronic conditions, and mental health support.

A comprehensive plan typically covers medical, dental, and vision care, as well as prescription drugs and mental health services.

This broad coverage enables employees to address their health needs holistically, leading to improved overall health and well-being.

The Benefits of a Healthy Workforce

A healthy workforce is a productive workforce. Employees who are healthy and well-cared for are more likely to be engaged, motivated, and productive.

Studies have shown that healthy employees are less likely to miss work due to illness, experience fewer workplace accidents, and contribute more effectively to their organizations.

Moreover, a healthy workforce fosters a positive work environment, reducing stress levels and improving morale.

The Role of Employee Education and Awareness

Promoting employee education and awareness about health insurance benefits and healthy lifestyle choices is crucial for maximizing the impact of employer-sponsored health insurance.

Employers can organize workshops, webinars, and health fairs to educate employees about their health insurance coverage, preventive care options, and healthy living strategies.

This proactive approach empowers employees to take ownership of their health and make informed decisions about their healthcare needs.

Employer Health Insurance and Legal Compliance

Navigating the legal landscape of employer-sponsored health insurance plans is crucial for employers to ensure compliance and avoid potential penalties. Employers must adhere to a complex web of federal and state regulations, including the Affordable Care Act (ACA), the Employee Retirement Income Security Act (ERISA), and various state-specific mandates. Understanding these requirements and implementing appropriate practices is essential for managing legal risks and maintaining a compliant health insurance program.

The Affordable Care Act (ACA)

The ACA, enacted in 2010, significantly impacted employer-sponsored health insurance. It introduced various provisions that employers must comply with, including:

* Minimum Value: Employers offering health insurance plans must ensure that the plans provide a minimum level of coverage, measured as a percentage of covered benefits.

* Essential Health Benefits: Plans must cover a set of essential health benefits, including preventive care, hospitalization, and prescription drugs.

* Employer Shared Responsibility: Employers with 50 or more full-time equivalent employees are subject to a penalty if they do not offer affordable health insurance coverage to their employees.

* Transparency and Disclosure: The ACA mandates that employers provide employees with clear and concise information about their health insurance plans, including costs, coverage, and benefits.

Employee Retirement Income Security Act (ERISA)

ERISA is a federal law that governs employer-sponsored benefit plans, including health insurance. It establishes standards for plan administration, fiduciary responsibilities, and disclosure requirements. Key ERISA provisions relevant to employer health insurance include:

* Fiduciary Duties: Employers offering health insurance plans have fiduciary duties to act in the best interests of their employees. This includes selecting and managing plans responsibly, ensuring that plan assets are used for the intended purpose, and providing accurate and timely information to employees.

* Plan Administration: ERISA sets forth requirements for plan administration, including recordkeeping, claims processing, and grievance procedures.

* Disclosure Requirements: ERISA requires employers to provide employees with a summary plan description (SPD) that Artikels the terms of the plan, including benefits, costs, and eligibility requirements.

State-Specific Regulations

In addition to federal regulations, employers must also comply with state-specific health insurance laws. These laws can vary significantly from state to state and may cover topics such as:

* Minimum Essential Coverage: Some states have their own minimum essential coverage requirements that go beyond the ACA’s requirements.

* Premium Taxes: States may impose taxes on employer-sponsored health insurance premiums.

* Mental Health Parity: Some states have parity laws that require health insurance plans to provide equal coverage for mental health and substance abuse treatment.

* Guaranteed Issue and Renewability: States may have laws that guarantee access to health insurance coverage for individuals with pre-existing conditions.

Communication with Employees

Accurate and transparent communication with employees regarding health insurance plans and coverage is crucial for compliance and employee satisfaction. Employers should:

* Provide Clear and Concise Information: Provide employees with clear and concise information about their health insurance plan, including coverage, benefits, costs, and enrollment procedures.

* Offer Multiple Communication Channels: Make information available through multiple channels, such as online portals, employee handbooks, and in-person meetings.

* Address Employee Concerns: Actively address employee questions and concerns about their health insurance coverage.

Managing Legal Risks

Employers can manage legal risks associated with employer-sponsored health insurance programs by:

* Staying Informed: Stay current on federal and state regulations and any changes that may impact their health insurance plans.

* Seeking Legal Advice: Consult with legal counsel to ensure compliance with all applicable laws and regulations.

* Maintaining Accurate Records: Keep detailed records of plan administration, employee enrollment, and claims processing.

* Implementing Strong Governance: Establish a strong governance structure for the health insurance program, including a clear chain of command and procedures for decision-making.

Case Studies: Employer Health Insurance Success Stories

Numerous employers have implemented innovative health insurance programs, achieving positive results in terms of cost savings, employee well-being, and improved healthcare outcomes. These success stories offer valuable insights into the strategies that can drive successful health insurance programs and enhance employee health and productivity.

Case Study: The Impact of a Wellness Program on Employee Health and Productivity

A large technology company, based in Silicon Valley, implemented a comprehensive wellness program that included health screenings, fitness challenges, and nutrition education. The program’s aim was to encourage employees to take ownership of their health and reduce healthcare costs. The program’s success is evident in the significant reduction in healthcare costs, improved employee engagement, and increased productivity.

| Metric | Before Wellness Program | After Wellness Program |

|---|---|---|

| Employee Participation Rate | 25% | 75% |

| Healthcare Costs per Employee | $5,000 | $4,000 |

| Employee Absenteeism Rate | 5% | 3% |

Case Study: The Effectiveness of a High-Deductible Health Plan with a Health Savings Account (HSA)

A mid-sized manufacturing company adopted a high-deductible health plan (HDHP) coupled with a health savings account (HSA). This approach encouraged employees to become more conscious of their healthcare spending and incentivized them to make informed healthcare decisions. The company witnessed a decrease in healthcare costs and a significant increase in employee engagement in their health.

| Metric | Before HDHP/HSA | After HDHP/HSA |

|---|---|---|

| Employee Participation in HSA | 10% | 90% |

| Healthcare Costs per Employee | $6,000 | $5,000 |

| Employee Satisfaction with Health Plan | 70% | 85% |

Case Study: The Benefits of Telemedicine for Employee Healthcare Access

A national retail chain implemented a telemedicine program to provide employees with convenient and affordable access to healthcare services. The program allowed employees to consult with doctors remotely, reducing the need for in-person visits and minimizing disruptions to their work schedules. The program resulted in increased employee satisfaction, reduced healthcare costs, and improved access to healthcare.

| Metric | Before Telemedicine | After Telemedicine |

|---|---|---|

| Telemedicine Utilization Rate | 0% | 50% |

| Healthcare Costs per Employee | $4,500 | $4,000 |

| Employee Satisfaction with Healthcare Access | 75% | 90% |

Future Trends in Employer Health Insurance

The landscape of employer health insurance is undergoing a rapid transformation, driven by technological advancements, evolving demographics, and shifting healthcare needs. This evolution presents both challenges and opportunities for employers seeking to maintain the long-term sustainability and effectiveness of their health insurance programs.

The Impact of Emerging Technologies

Emerging technologies are poised to revolutionize the way employer health insurance is delivered and consumed. Personalized medicine, artificial intelligence (AI), and wearable technology are emerging as key drivers of this transformation.

- Personalized Medicine: Personalized medicine tailors treatment plans based on an individual’s unique genetic makeup and lifestyle factors. This approach promises to improve treatment outcomes and reduce healthcare costs by targeting interventions more effectively. For example, genetic testing can identify individuals at higher risk for certain diseases, allowing for preventive measures and early intervention.

- Artificial Intelligence (AI): AI is being increasingly used to analyze large datasets, identify patterns, and predict health outcomes. AI-powered tools can help employers optimize their health insurance plans, predict future healthcare costs, and personalize benefits based on individual needs. For example, AI algorithms can analyze employee health data to identify individuals at risk of developing chronic conditions, enabling early intervention and cost savings.

- Wearable Technology: Wearable devices, such as fitness trackers and smartwatches, are collecting real-time data on employee health and activity levels. This data can be used to promote healthy behaviors, monitor individual health trends, and provide personalized health recommendations. For example, employers can use wearable technology to incentivize employees to engage in physical activity, track their progress, and reward healthy behaviors.

Wrap-Up

As the healthcare landscape continues to evolve, understanding the dynamics of employer health insurance is more critical than ever. By staying informed about the latest trends, embracing innovative cost-management strategies, and prioritizing employee well-being, employers can navigate this complex terrain and create a sustainable and effective healthcare system for their workforce. The future of employer health insurance lies in a collaborative approach, where employers, employees, and policymakers work together to ensure access to affordable, high-quality care for all.