Renters insurance is a crucial safety net for anyone who leases their living space. While often overlooked, it provides essential protection against unforeseen events that could lead to financial hardship. Understanding the average cost of renters insurance and the factors influencing premiums is essential for making informed decisions about your financial security. This guide delves into the intricacies of renters insurance, offering insights into its coverage, pricing, and strategies for finding affordable options.

From the basics of what renters insurance covers to navigating the complexities of policy exclusions and claim processes, this comprehensive resource equips renters with the knowledge they need to make informed decisions about their insurance needs. Whether you’re a seasoned renter or just starting out, understanding the average cost and key considerations of renters insurance is a critical step towards financial preparedness.

What is Renters Insurance?

Renters insurance is a type of property insurance that protects your personal belongings and provides liability coverage in case of unexpected events. It safeguards you from financial losses due to damage or theft of your possessions while living in a rented property.

Purpose of Renters Insurance

Renters insurance is designed to provide financial protection against various risks that could affect your personal belongings and your financial well-being. It aims to cover losses resulting from incidents like fire, theft, vandalism, or natural disasters.

Definition of Renters Insurance

Renters insurance is a policy that provides coverage for your personal property and liability risks while you are renting a home or apartment. It typically includes coverage for your belongings, such as furniture, electronics, clothing, and personal items, against damage or theft. Additionally, it offers liability coverage for injuries or property damage caused to others by you or members of your household.

Benefits of Renters Insurance

Renters insurance offers several key benefits that can provide peace of mind and financial security:

- Protection for Your Belongings: Renters insurance covers your personal property against damage or theft from various causes, including fire, theft, vandalism, and natural disasters. This ensures that you are financially protected if your belongings are lost or damaged.

- Liability Coverage: The policy also includes liability coverage, which protects you from financial losses if someone is injured or their property is damaged on your premises. This coverage can be crucial in case of accidents or lawsuits.

- Additional Living Expenses: In the event of a covered loss, renters insurance can help cover additional living expenses, such as hotel stays or temporary housing, while your home is being repaired or rebuilt. This provides financial support during a difficult time.

- Affordable Coverage: Renters insurance is generally very affordable, with premiums typically costing less than $20 per month. The cost can vary depending on factors such as the value of your belongings, your location, and the level of coverage you choose.

- Peace of Mind: Having renters insurance provides peace of mind knowing that you are financially protected against unexpected events. It can help alleviate stress and financial burdens in case of a covered loss.

What Does Average Renters Insurance Cover?

Renters insurance provides financial protection against various perils that could affect your belongings and your liability as a tenant. It’s a relatively affordable way to safeguard your assets and peace of mind. Understanding the specific coverages included in a typical renters insurance policy is crucial for making an informed decision.

Personal Property Coverage

This is the core of renters insurance, covering your personal belongings against covered perils. It’s important to understand the specific items covered and any limitations.

- Most policies cover common household items like furniture, clothing, electronics, appliances, and kitchenware.

- Some policies may have specific limits on certain items, such as jewelry, artwork, or collectibles. You may need additional coverage for these high-value items.

- Renters insurance typically covers your belongings both inside and outside your apartment, up to a certain limit. This includes items stored in your car or on your balcony.

Liability Coverage

Liability coverage protects you from financial losses if someone is injured or their property is damaged on your premises, regardless of fault. This coverage is essential for renters as it can help cover legal fees, medical expenses, and property damage costs.

- Liability coverage typically covers accidents involving visitors, guests, or even your pet.

- It can also protect you if you accidentally damage your landlord’s property, even if it was not your fault.

- Liability coverage is often capped at a certain limit, such as $100,000 or $300,000, which means the insurer will only pay up to that amount for covered claims.

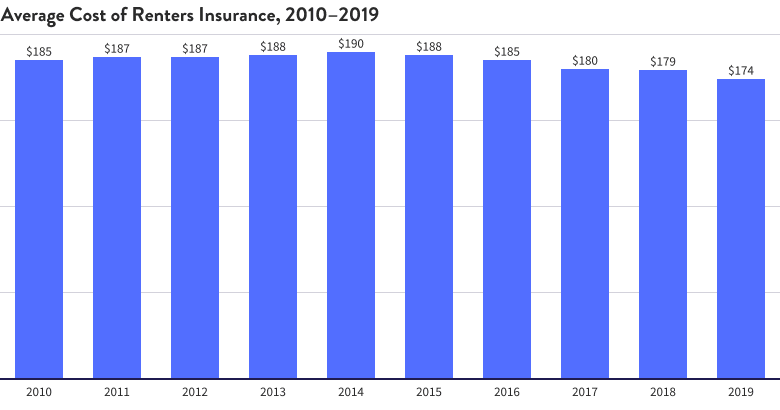

Factors Influencing Average Renters Insurance Costs

Renters insurance premiums are influenced by various factors, each contributing to the overall cost. Understanding these factors can help you make informed decisions and potentially reduce your premiums.

Location

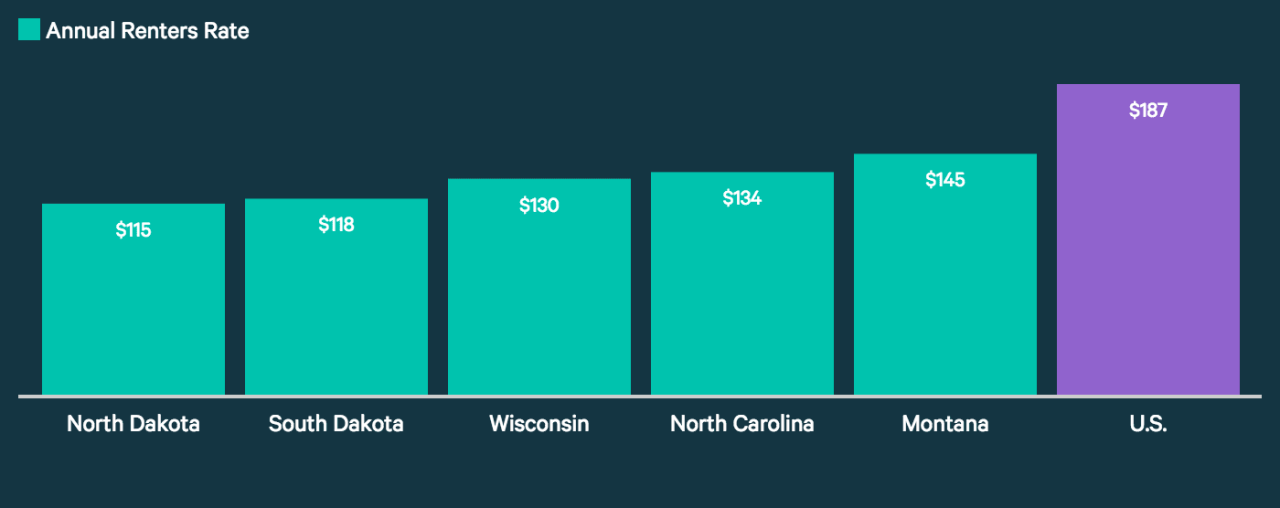

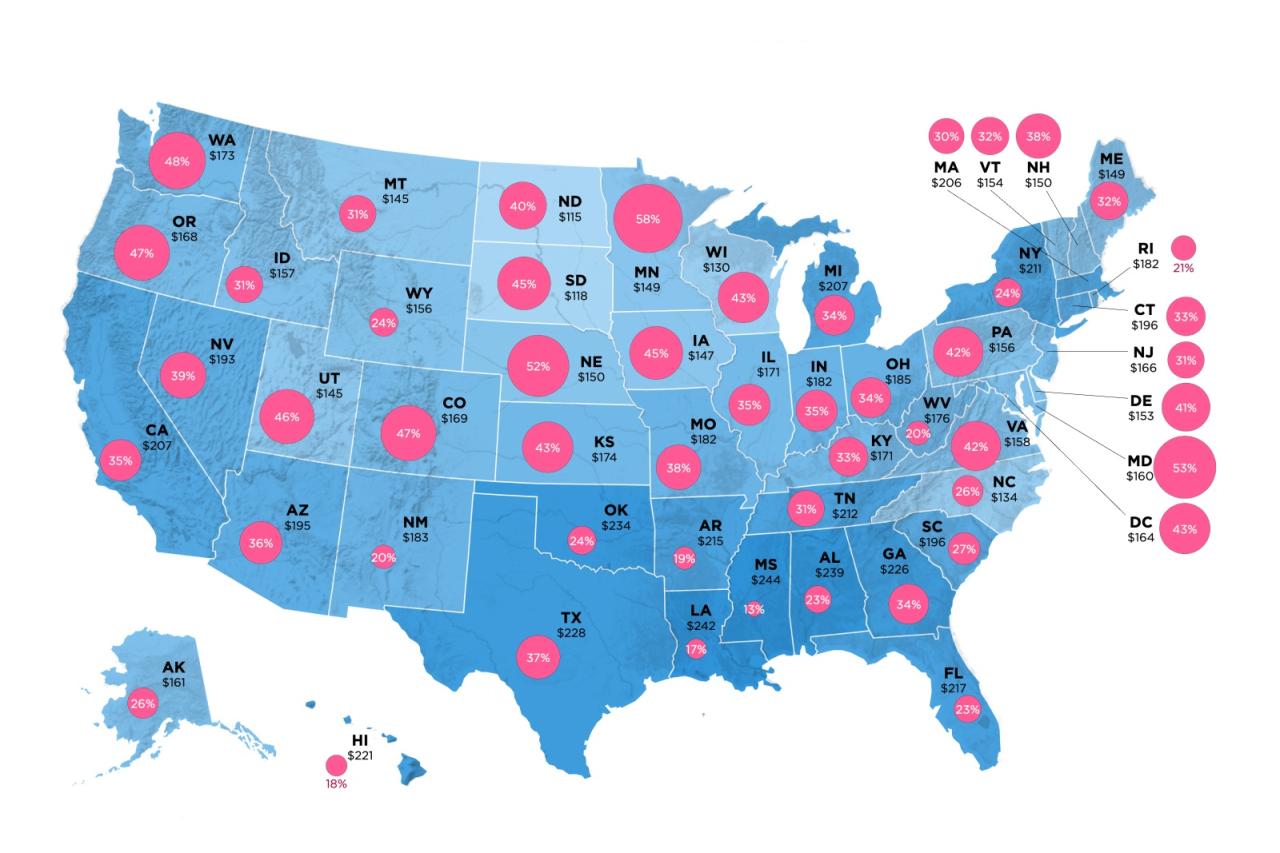

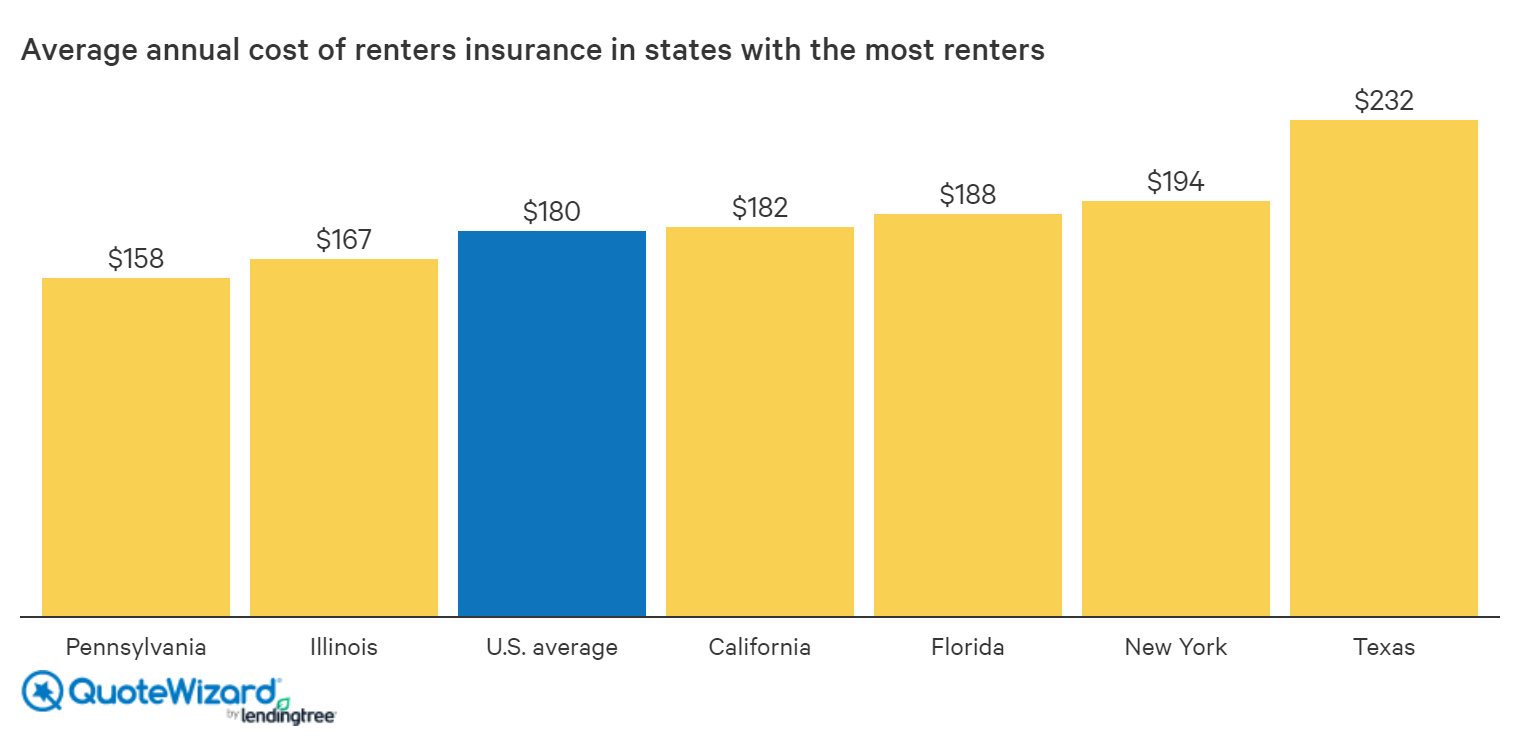

Location is a significant factor in determining renters insurance premiums. This is because insurance companies consider the risk of potential events, such as theft, fire, and natural disasters, in different geographic areas.

- Areas with higher crime rates or a greater frequency of natural disasters, such as earthquakes or hurricanes, typically have higher insurance premiums. For example, coastal areas may have higher premiums due to the risk of hurricanes.

- Urban areas often have higher premiums than rural areas due to higher property values and a greater concentration of people, which increases the risk of theft or other incidents.

Coverage Amount

The amount of coverage you choose for your renters insurance policy directly impacts your premiums.

- Higher coverage amounts mean you will pay higher premiums. This is because you are insuring your belongings for a greater value, increasing the potential payout for the insurance company in case of a claim.

- It’s crucial to choose coverage that adequately protects your belongings. However, consider your budget and the value of your possessions when selecting the coverage amount. Overinsuring can lead to unnecessary expenses, while underinsuring could leave you financially vulnerable in the event of a loss.

Deductibles

Your deductible is the amount you agree to pay out of pocket in the event of a claim before your insurance coverage kicks in.

- Higher deductibles typically result in lower premiums. This is because you are taking on more financial responsibility in the event of a loss, reducing the potential payout for the insurance company.

- When choosing a deductible, consider your financial situation and risk tolerance. A higher deductible may save you money on premiums, but you will need to be prepared to pay more out of pocket if you need to file a claim.

Insurance Provider

Different insurance providers offer varying premiums and coverage options.

- Comparing quotes from multiple insurers is essential to find the best value for your needs.

- Factors such as the insurer’s financial stability, customer service reputation, and claims handling process should be considered when choosing a provider.

Average Premiums by Provider

Here is a table comparing average renters insurance premiums from different insurance providers:

| Insurance Provider | Average Premium |

|---|---|

| Provider A | $15-$25 per month |

| Provider B | $18-$30 per month |

| Provider C | $20-$35 per month |

Note: These premiums are estimates and may vary based on factors such as coverage amount, deductible, location, and individual risk profile.

How to Find Affordable Renters Insurance

Finding affordable renters insurance doesn’t have to be a daunting task. By following a few simple steps, you can ensure you have adequate coverage without breaking the bank.

Comparing Quotes Online

To find the most competitive rates, it’s essential to compare quotes from multiple insurers. Several websites specialize in helping you do just that. These platforms allow you to enter your details once and receive quotes from various insurers, saving you time and effort.

- Insurance comparison websites: Websites like Policygenius, Insurify, and NerdWallet allow you to compare quotes from multiple insurers side-by-side. These sites typically offer a user-friendly interface and allow you to filter quotes based on your specific needs and budget.

- Direct insurer websites: Many insurers offer online quote tools on their websites. This allows you to directly compare rates from specific insurers without going through a third-party comparison platform.

Negotiating with Insurance Providers

Once you’ve identified a few insurers with competitive rates, you can try to negotiate a lower premium. Insurance companies are often willing to negotiate, especially if you’re a good customer with a clean claims history.

- Bundle your policies: Combining your renters insurance with other insurance policies, such as car insurance, can often result in discounts. Many insurers offer discounts for bundling multiple policies.

- Increase your deductible: A higher deductible means you pay more out of pocket if you file a claim, but it can also lower your premium. Consider increasing your deductible if you’re comfortable with a higher out-of-pocket expense in exchange for lower premiums.

- Ask about discounts: Many insurers offer discounts for things like safety features in your apartment, security systems, or being a good student. Be sure to ask about any available discounts that you may qualify for.

- Shop around regularly: Insurance rates can fluctuate over time, so it’s a good idea to shop around for new quotes every year or two, even if you’re happy with your current insurer. This can help ensure you’re getting the best possible rate.

Understanding Policy Exclusions

Renters insurance policies are designed to protect your belongings from unforeseen events, but they also come with limitations. Understanding these exclusions is crucial for ensuring you have the right coverage for your needs.

Common Exclusions in Renters Insurance Policies

Renters insurance policies typically exclude coverage for certain events, property types, and situations.

- Acts of War: Renters insurance policies generally do not cover damage or loss resulting from acts of war, including war-related events such as explosions, military actions, and civil unrest.

- Nuclear Accidents: Damage or loss caused by nuclear accidents, including radiation, is typically excluded from renters insurance policies.

- Earthquakes: While some policies may offer optional earthquake coverage, it is generally not included in standard renters insurance.

- Flooding: Damage caused by flooding, including rising water from rivers, lakes, or heavy rainfall, is typically excluded from renters insurance policies. However, you may be able to purchase flood insurance separately.

- Intentional Acts: Damage or loss resulting from intentional acts, such as arson or vandalism by the insured, is generally excluded from coverage.

Property Types Not Covered

Renters insurance policies often have limitations on the types of property they cover.

- High-Value Items: Renters insurance policies may have limits on the coverage for certain high-value items, such as jewelry, artwork, and collectibles. You may need to purchase additional coverage for these items.

- Pets: Renters insurance policies typically do not cover damage or loss caused by pets, including injuries or property damage.

- Cash: Renters insurance policies typically have limits on the amount of cash they will cover. You may need to consider other options for protecting large sums of cash.

- Business Property: Renters insurance policies generally do not cover property used for business purposes. If you operate a business from your home, you may need to purchase separate business insurance.

Situations Where Coverage May Not Apply

There are situations where renters insurance coverage may not apply, even if the event is not specifically excluded.

- Negligence: If damage or loss occurs due to your negligence, your insurance company may not cover the entire cost. For example, if you leave a window open during a storm and your belongings are damaged by rain, your insurance company may only cover a portion of the loss.

- Failure to Take Reasonable Precautions: Your insurance company may deny coverage if you fail to take reasonable precautions to protect your belongings. For instance, if you leave valuable items in plain sight and they are stolen, your insurance company may argue that you were not sufficiently careful.

- Pre-existing Conditions: Renters insurance policies generally do not cover damage or loss caused by pre-existing conditions. For example, if you have a leaky roof and your belongings are damaged by water, your insurance company may not cover the loss if the leak was present before you purchased the policy.

Filing a Renters Insurance Claim

Filing a renters insurance claim is a crucial step in recovering from a covered loss. It’s a straightforward process, but understanding the steps and required documentation is essential for a smooth and successful claim.

Filing a Claim

After experiencing a covered loss, contact your insurance company as soon as possible. This can be done through their website, phone, or mobile app. Your insurer will guide you through the initial steps, which typically involve:

- Providing your policy details.

- Describing the incident that caused the loss.

- Providing your contact information and preferred communication methods.

Required Documentation

To support your claim, you’ll need to provide specific documentation to your insurer. This may include:

- Proof of loss: This can be a police report, a fire department report, or any other relevant documentation that verifies the incident. It should detail the date, time, and location of the loss, as well as the cause and extent of the damage.

- Inventory of damaged property: Create a detailed list of all items that were damaged or lost, including their purchase date, cost, and any other relevant information. Photos or videos of the damaged items can also be helpful.

- Receipts and invoices: If possible, provide receipts or invoices for the damaged or lost items. This can help expedite the claims process and ensure you receive fair compensation.

Tips for Navigating the Claim Process

- Keep detailed records: Maintain thorough records of all communication with your insurer, including dates, times, and details of conversations. This can be helpful if any disputes arise later.

- Be proactive: Follow up with your insurer regularly to check on the status of your claim and ensure that all necessary information has been provided. Be prepared to answer any questions they may have.

- Understand your policy: Before filing a claim, carefully review your policy to understand the coverage limits, deductibles, and any exclusions that may apply. This will help you avoid surprises during the claims process.

Renters Insurance vs. Homeowners Insurance

Renters insurance and homeowners insurance are both essential forms of protection for your belongings and financial well-being. While they share some similarities, they cater to distinct needs and offer different levels of coverage. Understanding the key differences between these two types of insurance can help you choose the right policy for your specific circumstances.

Coverage Differences

Renters insurance and homeowners insurance provide coverage for different aspects of your property and liabilities.

- Renters insurance primarily protects your personal belongings from damage or loss due to covered perils such as fire, theft, or vandalism. It also provides liability coverage for injuries or property damage that you may cause to others.

- Homeowners insurance, on the other hand, covers both the structure of your home and your personal belongings. It also provides liability coverage, but the scope of coverage may be broader than renters insurance.

Benefits of Renters Insurance

Renters insurance offers several benefits that can protect you from financial hardship.

- Protection of Personal Belongings: Renters insurance provides coverage for your personal belongings, including furniture, electronics, clothing, and jewelry, against various perils. This can be crucial in case of theft, fire, or other covered events.

- Liability Coverage: Renters insurance includes liability coverage, which protects you from financial losses if someone is injured on your property or you accidentally damage someone else’s property.

- Additional Living Expenses: In the event of a covered loss that makes your rental unit uninhabitable, renters insurance can cover additional living expenses, such as temporary housing and meals.

Benefits of Homeowners Insurance

Homeowners insurance offers comprehensive protection for your property and financial well-being.

- Structure Coverage: Homeowners insurance covers the structure of your home, including the roof, walls, and foundation, against covered perils.

- Personal Belongings Coverage: Similar to renters insurance, homeowners insurance protects your personal belongings from damage or loss.

- Liability Coverage: Homeowners insurance provides liability coverage, which protects you from financial losses if someone is injured on your property or you accidentally damage someone else’s property.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, homeowners insurance can cover additional living expenses, such as temporary housing and meals.

Specific Needs of Renters vs. Homeowners

Renters and homeowners have distinct insurance needs based on their ownership status and responsibilities.

- Renters primarily need insurance to protect their personal belongings and to cover liability risks. They are not responsible for insuring the structure of the building.

- Homeowners need insurance to protect both the structure of their home and their personal belongings. They are responsible for maintaining and insuring their property.

Importance of Adequate Coverage

Renters insurance is designed to protect your belongings and provide financial security in the event of unexpected events. However, the level of coverage you choose can significantly impact the financial consequences of a covered incident. Underestimating your needs or opting for minimal coverage can leave you financially vulnerable, potentially jeopardizing your financial stability.

Consequences of Underinsured Renters

The consequences of being underinsured can be substantial, leaving renters with significant financial burdens. If you are underinsured, you may be responsible for covering the costs of replacing or repairing your belongings out of pocket. This can lead to significant financial hardship, especially in the event of a major disaster.

Importance of Having Sufficient Coverage for Belongings

Determining the appropriate level of coverage for your belongings is crucial to ensure adequate protection. It is important to consider the value of your possessions, including furniture, electronics, clothing, and personal items. A thorough inventory of your belongings, including documentation with receipts, can help you estimate the replacement cost.

Real-Life Scenarios Where Adequate Coverage Is Crucial

- Fire: A fire in your apartment building could destroy all your belongings, leaving you with nothing. Adequate renters insurance would cover the cost of replacing your lost items, providing you with financial security during a difficult time.

- Theft: A break-in can result in the loss of valuable belongings. Renters insurance can cover the cost of replacing stolen items, including electronics, jewelry, and other valuables.

- Water Damage: A burst pipe or a leak from a neighbor’s apartment could cause significant water damage to your belongings. Renters insurance can cover the cost of repairs and replacement, ensuring you can recover from the damage.

- Natural Disasters: Storms, earthquakes, and other natural disasters can cause widespread damage. Renters insurance can provide financial assistance to help you rebuild your life after a natural disaster.

Tips for Protecting Your Belongings

Renters insurance is a valuable investment, but it’s crucial to remember that it’s a safety net, not a replacement for proactive measures to protect your belongings. Taking steps to prevent theft and damage can significantly reduce your risk of loss and even lower your insurance premiums.

Safeguarding Your Home

It’s essential to create a secure environment to deter potential thieves. Simple steps can make a significant difference in protecting your belongings.

- Install a reliable home security system: A security system, including alarms, motion sensors, and surveillance cameras, can deter potential burglars and provide evidence in case of a break-in.

- Use strong, secure locks on all doors and windows: Ensure all locks are in good working condition and replace any damaged or faulty locks. Consider upgrading to high-quality deadbolt locks for added security.

- Keep valuables out of sight: Avoid leaving valuable items visible through windows or doors. Consider using a safe or a lockbox to store important documents, jewelry, and other valuables.

- Light up your property: Install motion-activated outdoor lighting to deter criminals by illuminating potential entry points and making your home appear occupied.

- Don’t advertise your absence: When going on vacation, avoid posting about your trip on social media. Consider having a trusted neighbor collect your mail and newspapers to prevent your home from appearing empty.

Protecting Against Damage

While you can’t prevent every disaster, taking preventive measures can significantly reduce the risk of damage to your belongings.

- Maintain your appliances: Regularly inspect and maintain your appliances, particularly those with heating elements, to prevent malfunctions and fires.

- Install smoke detectors and carbon monoxide detectors: These devices can alert you to potential dangers, giving you time to evacuate and reduce the risk of injury or property damage.

- Prevent water damage: Inspect plumbing regularly for leaks, and promptly address any issues. Consider installing a water leak detection system to alert you to potential problems.

- Protect your electronics: Use surge protectors to protect your electronics from power surges, and consider purchasing a backup power supply to safeguard against power outages.

- Store flammable materials safely: Keep flammable liquids and other hazardous materials in secure, well-ventilated areas, away from heat sources.

Additional Safety Tips

Beyond securing your home and preventing damage, there are additional steps you can take to protect your belongings.

- Keep a detailed inventory of your belongings: This can be a crucial resource if you need to file a claim, providing proof of ownership and value. Consider taking photos or videos of your belongings and storing them in a secure location, such as a cloud storage service.

- Keep your renters insurance policy up-to-date: Regularly review your policy to ensure it still meets your needs and provides adequate coverage for your belongings.

- Be cautious about who you let into your home: Don’t open your door to strangers, and be wary of unsolicited sales calls or repair services.

- Don’t leave your keys unattended: Always keep your keys secure, and never leave them in plain sight, especially not near your front door.

Outcome Summary

In the end, securing adequate renters insurance is an investment in your financial well-being. By understanding the average costs, coverage options, and key factors influencing premiums, you can make informed decisions to safeguard your belongings and financial stability. With the right coverage, you can rest assured that you’re protected against unforeseen events, allowing you to focus on what truly matters in life.