Navigating the world of auto insurance can feel like driving through a maze. With countless providers, coverage options, and factors influencing your premiums, finding the right protection for your needs can be a daunting task. But fear not, this comprehensive guide will equip you with the knowledge and tools to confidently secure the auto insurance coverage you need, right in your neighborhood.

We’ll delve into the essential types of auto insurance, the factors that impact your premiums, and the strategies for finding the best deals in your area. We’ll also cover crucial aspects like understanding policy exclusions, filing claims, and maintaining adequate coverage throughout your vehicle ownership.

Understanding Auto Insurance Coverage

Navigating the world of auto insurance can be overwhelming, especially with the numerous coverage options available. Understanding the different types of coverage and their importance is crucial for making informed decisions about your insurance policy. This information empowers you to choose the right coverage that aligns with your specific needs and budget.

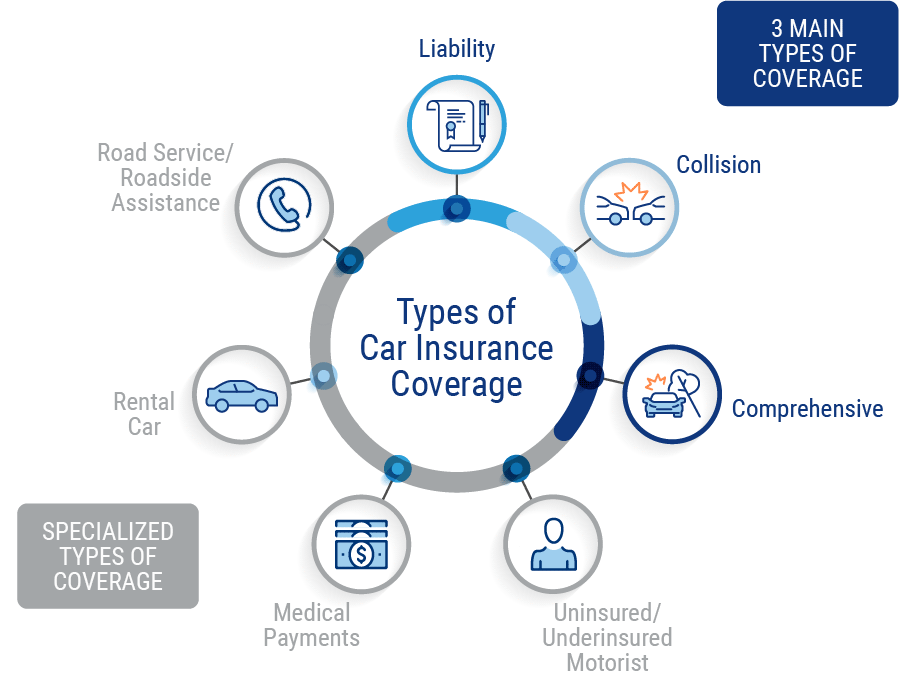

Types of Auto Insurance Coverage

Auto insurance policies typically include various types of coverage designed to protect you financially in the event of an accident or other covered events. These coverages are designed to address different aspects of potential risks, providing comprehensive protection for you and your vehicle.

- Liability Coverage: This is the most common type of auto insurance, providing financial protection if you are at fault in an accident that causes damage to another person’s property or injuries to another person. Liability coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other related costs incurred by the other party due to injuries caused by you in an accident. It typically has a limit per person and a limit per accident.

- Property Damage Liability: This coverage pays for damages to the other party’s vehicle or property caused by you in an accident. It typically has a limit per accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional and often has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the remaining costs.

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by events other than an accident, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional and typically has a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. This coverage can pay for medical expenses, lost wages, and other related costs.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. PIP coverage is mandatory in some states.

- Medical Payments Coverage (MedPay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. MedPay is optional and has a limit per person.

Importance of Auto Insurance Coverage

Each type of auto insurance coverage serves a specific purpose, providing protection in different situations. Understanding the importance of each coverage helps you determine the right combination for your needs.

- Liability Coverage: This is essential for protecting yourself financially from potential lawsuits arising from accidents you cause. It is important to have adequate liability limits to cover potential damages, especially in situations where you are found liable for significant injuries or property damage.

- Collision Coverage: This coverage is particularly important if you have a newer vehicle or a loan on your vehicle. It provides financial protection for repairs or replacement if your vehicle is damaged in an accident, even if you are not at fault. However, if your vehicle is older and you have a lower loan balance, you might consider dropping collision coverage to reduce your premium.

- Comprehensive Coverage: This coverage is valuable for protecting your vehicle against various risks beyond accidents, such as theft, vandalism, and natural disasters. If you live in an area prone to such events, comprehensive coverage can be crucial. However, if you have an older vehicle with a low value, you might choose to forgo this coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage is essential for protecting yourself financially if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. In such cases, this coverage can help you pay for your medical expenses, lost wages, and other related costs.

- Personal Injury Protection (PIP): This coverage is particularly important in states where it is mandatory. It provides financial protection for you and your passengers, regardless of who is at fault in an accident, for medical expenses, lost wages, and other related costs.

- Medical Payments Coverage (MedPay): This coverage can be useful as a supplement to your health insurance, providing additional coverage for medical expenses in the event of an accident. It can be especially beneficial if you have a high deductible on your health insurance plan.

Common Insurance Terms

Understanding common insurance terms is essential for making informed decisions about your auto insurance policy. These terms help you navigate the intricacies of insurance policies and make sense of the coverage options available.

- Deductible: This is the amount you pay out-of-pocket for covered repairs or replacements before your insurance company starts paying. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

- Premium: This is the amount you pay for your insurance policy on a regular basis, typically monthly or annually. Your premium is determined by factors such as your driving history, age, location, vehicle type, and coverage options.

- Coverage Limits: These are the maximum amounts your insurance company will pay for covered expenses, such as medical bills, property damage, or lost wages. Coverage limits are typically set per person, per accident, or per policy.

Factors Affecting Auto Insurance Costs

Auto insurance premiums are not a one-size-fits-all proposition. Numerous factors contribute to the cost of coverage, and understanding these factors can help you navigate the process of finding the best and most affordable insurance policy.

Driving History

Your driving history is a significant factor in determining your insurance premium. Insurance companies assess your risk based on past driving behavior, specifically the number and severity of accidents and traffic violations. A clean driving record typically translates to lower premiums, while a history of accidents, speeding tickets, or driving under the influence can lead to higher rates.

Age

Age plays a role in insurance premiums as younger drivers are statistically more likely to be involved in accidents. This higher risk is reflected in higher insurance rates for young drivers. As drivers gain experience and age, their premiums tend to decrease. However, senior drivers (typically over 65) may also face higher premiums due to potential health concerns or reduced reaction times.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. High-performance cars, luxury vehicles, and vehicles with a history of theft or accidents are generally more expensive to insure. This is due to factors such as repair costs, replacement value, and the likelihood of theft or accidents.

Location

The location where you live can significantly impact your auto insurance premiums. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents tend to have higher insurance rates. Urban areas, for instance, often have higher premiums compared to rural areas due to increased traffic density and higher risk of accidents.

Credit Score

While it might seem surprising, your credit score can also influence your auto insurance rates. Insurance companies use credit scores as a proxy for financial responsibility, assuming that individuals with good credit are more likely to be responsible drivers. Higher credit scores are often associated with lower insurance premiums, while lower credit scores may result in higher rates.

Finding the Best Auto Insurance Near You

Securing the most suitable auto insurance policy requires careful consideration and a comprehensive approach. Comparing quotes from multiple insurance providers is essential to finding the best coverage at the most competitive price. This process involves evaluating various factors, including your individual needs, driving history, vehicle type, and location.

Comparing Quotes from Multiple Providers

Obtaining quotes from several insurance companies is crucial to ensure you’re getting the best deal. This practice allows you to compare coverage options, premiums, and deductibles across different providers.

“Don’t settle for the first quote you receive. Shop around and compare prices from at least three to five different insurers.”

By comparing quotes, you can identify the most favorable terms and potentially save a significant amount of money on your auto insurance premiums.

Searching for Auto Insurance Quotes

There are several effective methods for searching for auto insurance quotes:

Online Quote Comparison Websites

Numerous websites specialize in comparing quotes from various insurance companies. These platforms streamline the process by allowing you to enter your information once and receive multiple quotes instantly. Popular websites include:

- Insurify

- Policygenius

- The Zebra

These websites provide a convenient and efficient way to gather quotes from multiple providers without having to contact each company individually.

Local Insurance Agents

Local insurance agents can provide personalized advice and guidance when selecting an auto insurance policy. They have a deep understanding of the local market and can help you navigate the complexities of insurance coverage. Agents can also assist with:

- Understanding your specific needs

- Identifying potential discounts

- Negotiating premiums

While online quote comparison websites are useful, consulting with a local agent can offer valuable insights and personalized support.

Reputable Insurance Companies

Several reputable insurance companies operate in various regions, offering comprehensive auto insurance coverage. These companies have a strong track record of customer satisfaction and financial stability. Examples include:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

It’s essential to research each company’s reputation, financial strength, and customer reviews before making a decision.

Essential Considerations When Choosing Coverage

Selecting the right auto insurance policy is crucial to ensure you have adequate protection in case of an accident or other unforeseen events. It’s essential to consider several factors to make an informed decision that balances affordability with comprehensive coverage.

Coverage Limits and Deductibles

Understanding coverage limits and deductibles is essential when choosing auto insurance. Coverage limits define the maximum amount your insurer will pay for specific types of claims, such as bodily injury or property damage. Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in.

For example, a policy with a $100,000 bodily injury liability limit means your insurer will pay up to $100,000 per person and $300,000 per accident for injuries caused by you.

Higher coverage limits generally translate to higher premiums, while higher deductibles mean lower premiums.

For example, a policy with a $1,000 deductible for collision coverage means you pay the first $1,000 of repair costs in case of an accident, and your insurer covers the rest.

Balancing Affordability and Protection

Finding the right balance between affordability and adequate protection is key. Consider the following factors:

- Your budget: Determine how much you can comfortably afford to pay for premiums.

- Your driving history: A clean driving record generally translates to lower premiums.

- Your vehicle’s value: The value of your vehicle influences the amount of coverage you need.

- Your lifestyle: If you frequently drive long distances or in high-traffic areas, you may need more comprehensive coverage.

- Available discounts: Many insurers offer discounts for factors such as good driving records, safety features, and multiple policies.

Understanding Policy Exclusions and Limitations

While auto insurance provides financial protection in the event of an accident, it’s crucial to understand that policies have exclusions and limitations. These stipulations Artikel situations where coverage may not apply, leaving you financially responsible for damages or losses.

Exclusions and Limitations in Auto Insurance Policies

Understanding the specific exclusions and limitations in your auto insurance policy is vital to avoid surprises and ensure adequate protection.

Common Exclusions

- Intentional Acts: Your policy generally won’t cover damages caused by your intentional actions, such as driving under the influence or deliberately causing an accident.

- Acts of War: Coverage typically excludes damages resulting from acts of war, terrorism, or civil unrest.

- Certain Vehicles: Some policies may exclude coverage for specific vehicles, such as motorcycles, recreational vehicles, or commercial vehicles, unless you have separate coverage for them.

- Wear and Tear: Normal wear and tear on your vehicle is not covered, such as worn tires or a broken windshield due to age or neglect.

- Mechanical Breakdown: Most policies exclude coverage for mechanical failures, such as engine problems or transmission issues. You might need separate coverage for these situations.

- Unlicensed Drivers: Policies often exclude coverage for accidents involving unlicensed or uninsured drivers. This highlights the importance of ensuring all drivers are properly licensed and insured.

- Driving Outside the Policy Area: Policies might limit coverage if you drive your vehicle outside the designated geographic area, such as a specific state or region.

- Non-Covered Property: Coverage may not extend to certain property in your vehicle, such as personal items of high value, unless you have additional coverage.

Common Limitations

- Deductible: Your policy likely includes a deductible, which is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles often lead to lower premiums.

- Coverage Limits: Policies often have limits on the amount of coverage provided for various aspects, such as bodily injury liability, property damage liability, and medical payments. These limits determine the maximum amount your insurer will pay for covered losses.

- Rental Car Coverage: While some policies offer rental car coverage, it might have limitations, such as a daily rental limit or a specific rental period.

- Coverage for Passengers: Policies may limit the amount of coverage available for passengers in your vehicle, especially if they are not family members or residing in your household.

The Importance of Reviewing Your Policy Documents

It’s crucial to review your auto insurance policy documents thoroughly. Carefully reading the policy language can help you understand the specific exclusions and limitations that apply to your coverage. This proactive step can help you avoid unpleasant surprises in the event of an accident or claim.

Real-World Examples of Policy Exclusions

Here are some real-world examples of situations where policy exclusions might apply:

Example 1: You’re driving under the influence and cause an accident. Your policy likely won’t cover damages because driving under the influence is an intentional act.

Example 2: You’re driving your vehicle in a war zone and it’s damaged. Your policy may exclude coverage for damages resulting from acts of war.

Example 3: Your vehicle’s engine fails due to a mechanical breakdown. Your policy may not cover the cost of repairs, as mechanical failures are often excluded.

Example 4: You’re involved in an accident with an unlicensed driver. Your policy might not cover damages if the other driver is unlicensed.

Example 5: You’re driving your vehicle outside of the designated coverage area and get into an accident. Your policy may limit or exclude coverage in this situation.

Filing a Claim and Understanding the Process

Filing an auto insurance claim is a crucial step when you’re involved in an accident. This process helps you receive compensation for damages and get your vehicle repaired or replaced. Understanding the steps involved and communicating effectively with your insurance provider can ensure a smoother claims experience.

Steps Involved in Filing an Auto Insurance Claim

Following an accident, it’s essential to take the necessary steps to file a claim promptly. This includes:

- Contact Your Insurance Provider: Immediately notify your insurance company about the accident. Provide details such as the date, time, location, and any injuries involved.

- File a Police Report: If the accident involves injuries, property damage, or a hit-and-run, it’s crucial to file a police report. This report will serve as documentation of the incident.

- Gather Evidence: Collect as much evidence as possible, including photographs of the accident scene, damage to your vehicle, and any injuries. Also, obtain contact information from other parties involved.

- Submit a Claim: Your insurance company will provide you with a claim form, which you need to fill out and submit with supporting documentation.

- Provide Necessary Information: Be prepared to answer questions about the accident and provide any requested information.

- Cooperate with Your Insurance Provider: Respond promptly to any requests from your insurance company and attend any scheduled appointments or inspections.

Effective Communication with Insurance Providers

Clear and concise communication is essential throughout the claims process. Here are some tips:

- Be Polite and Professional: Even in stressful situations, maintain a respectful tone when communicating with your insurance provider.

- Be Clear and Concise: When explaining the accident, provide accurate and detailed information. Avoid using jargon or technical terms.

- Keep Detailed Records: Document all communications with your insurance company, including dates, times, and the content of conversations.

- Ask Questions: If you have any questions or concerns, don’t hesitate to ask for clarification.

Challenges During the Claims Process

While the claims process aims to be straightforward, challenges can arise. Some common issues include:

- Disputes over Liability: When multiple parties are involved, determining fault and liability can be complex.

- Valuation Disputes: Disagreements can occur over the value of damaged property or the cost of repairs.

- Delay in Processing: Claims processing can take time, especially in complex cases or when additional information is required.

- Denial of Coverage: Your insurance company might deny coverage if they determine that the accident falls outside the terms of your policy.

Maintaining Your Coverage and Making Adjustments

Your auto insurance policy shouldn’t be a static document. As your life changes, so should your coverage to ensure you have the right protection.

Life events, such as getting married, having a child, purchasing a new vehicle, or moving to a different state, can significantly impact your insurance needs. Regularly reviewing and updating your policy helps ensure you have adequate coverage and avoid paying for unnecessary protection.

Updating Your Policy for Life Events

It’s essential to inform your insurance company about any significant life changes that could affect your policy. This includes:

- Marriage or Divorce: Adding or removing a spouse from your policy can impact your premiums and coverage.

- New Vehicle Purchase: You’ll need to add the new vehicle to your policy, specifying its make, model, year, and value. This can affect your premium based on factors like safety ratings and theft risk.

- Changes in Driving Habits: If you start driving less frequently, you may be eligible for discounts on your premiums. Similarly, increased driving, such as a new job requiring more commuting, could lead to higher premiums.

- Moving to a New Address: Your location affects your premiums, as different areas have varying risks of accidents and theft.

- Adding or Removing Drivers: Changes in the drivers on your policy can impact your premiums, particularly if a new driver has less experience or a poor driving record.

Adding or Removing Drivers

Adding or removing drivers from your policy is a straightforward process. Contact your insurance company and provide the necessary information about the driver, including their name, date of birth, driving history, and any relevant details.

When adding a driver, you’ll need to provide details about their driving experience, driving record, and any relevant information. The insurance company will assess their risk and adjust your premiums accordingly. Removing a driver involves simply informing your insurance company, who will update your policy and potentially adjust your premiums based on the number of drivers and their individual risk profiles.

Ensuring Adequate Coverage

To maintain adequate coverage throughout your vehicle ownership, follow these tips:

- Review Your Policy Regularly: At least annually, or more frequently if you experience life changes, review your policy to ensure it still meets your needs.

- Consider Increasing Coverage: As your vehicle ages, its value may decrease, but your coverage needs may not. You may need to increase your liability coverage to protect yourself financially in case of an accident.

- Shop Around for Better Rates: Don’t be afraid to compare quotes from other insurance companies to ensure you’re getting the best rates for your coverage.

- Take Advantage of Discounts: Many insurance companies offer discounts for safe driving, good grades, bundling policies, and other factors. Ask your insurance company about available discounts.

Tips for Saving Money on Auto Insurance

Auto insurance is a necessity for most drivers, but it can be a significant expense. Fortunately, there are several strategies you can employ to reduce your premiums and save money. By understanding these tactics, you can ensure you’re getting the best possible value for your coverage.

Safe Driving Practices and Good Driving Record

Maintaining a good driving record is crucial for obtaining lower insurance premiums. Insurance companies consider drivers with clean records as lower risk, leading to reduced rates. Safe driving practices, such as obeying traffic laws, avoiding speeding, and driving defensively, are essential for maintaining a good driving record.

“A clean driving record is a significant factor in determining your auto insurance rates. By avoiding accidents and traffic violations, you demonstrate responsible driving habits, which insurers reward with lower premiums.”

Negotiating with Insurance Providers

You have more leverage than you might think when it comes to negotiating with insurance providers. By comparing quotes from multiple insurers, you can leverage competition to secure better rates. Don’t be afraid to ask for discounts or explain your specific circumstances, such as a safe driving record or homeownership, to see if you qualify for additional savings.

“Be proactive in seeking out the best possible rates. By comparing quotes and engaging in open communication with insurers, you can negotiate favorable terms and potentially secure significant savings on your auto insurance.”

Discounts and Bundling

Insurance companies often offer a variety of discounts to their policyholders. These discounts can range from safe driving discounts to bundling discounts for multiple insurance policies. Researching available discounts and bundling options can lead to significant savings.

“Take advantage of the numerous discounts offered by insurers. Bundling your auto insurance with other policies, such as home or renter’s insurance, can often result in substantial cost reductions.”

Resources and Additional Information

Navigating the complexities of auto insurance can be challenging, but there are valuable resources available to help you make informed decisions and find the best coverage for your needs.

Reputable Online Resources for Auto Insurance Research

A wealth of information is readily accessible online, allowing you to compare quotes, understand policy details, and research insurance providers.

- Insurance Information Institute (III): This non-profit organization provides comprehensive resources on auto insurance, including industry statistics, consumer guides, and educational materials. The III offers insights into current trends and helps you understand the intricacies of auto insurance coverage.

- National Association of Insurance Commissioners (NAIC): The NAIC is a regulatory body for the insurance industry, providing information on state insurance regulations and consumer protection resources. You can find information on state-specific laws and regulations related to auto insurance, helping you understand your rights and responsibilities.

- Consumer Reports: This independent consumer organization offers unbiased reviews and ratings of auto insurance companies, based on factors like customer satisfaction, claims handling, and financial stability. Consumer Reports provides valuable insights to help you choose a reputable and reliable insurance provider.

- J.D. Power: Known for its automotive industry research, J.D. Power also conducts surveys and ratings for insurance companies, providing valuable information on customer satisfaction and claims handling. Their research helps you identify insurance companies that consistently deliver excellent customer experiences.

Contact Information for Local Insurance Agencies and Regulatory Bodies

Reaching out to local insurance agencies and regulatory bodies can provide personalized assistance and address specific questions you may have.

- Your State Insurance Department: Each state has an insurance department responsible for regulating the insurance industry and protecting consumer rights. You can contact your state insurance department to report complaints, seek information on insurance regulations, or get guidance on choosing coverage.

- Local Insurance Agents: Insurance agents can provide personalized advice and help you compare different policies and coverage options. They can also assist with the application process and ensure you understand the terms of your policy.

Role of Consumer Protection Organizations in the Insurance Industry

Consumer protection organizations play a vital role in advocating for consumer rights and ensuring fair and transparent insurance practices.

- Consumer Federation of America (CFA): The CFA advocates for consumer interests in various sectors, including insurance. They conduct research, publish reports, and engage in policy advocacy to protect consumers from unfair insurance practices.

- National Consumer Law Center (NCLC): The NCLC provides legal assistance and resources to consumers facing legal challenges related to insurance, including unfair claims practices and deceptive marketing. They also conduct research and advocate for policy changes to improve consumer protection in the insurance industry.

Understanding Your Rights as a Policyholder

As an auto insurance policyholder, you have certain rights and responsibilities that are crucial to understand. These rights are often enshrined in state insurance regulations, ensuring fair treatment and protecting your interests. Knowing your rights empowers you to navigate the insurance landscape effectively and advocate for yourself if needed.

State Insurance Regulations

State insurance regulations play a vital role in safeguarding the rights of policyholders. These regulations vary from state to state but generally cover key aspects like:

- Fair Pricing: State laws prevent insurance companies from charging excessive premiums based on discriminatory factors.

- Transparency: Insurers are required to provide clear and concise policy documents, explaining coverage, exclusions, and procedures for filing claims.

- Prompt Payment of Claims: State regulations set timelines for insurers to process and pay legitimate claims, preventing unreasonable delays.

- Consumer Protection: State laws establish procedures for resolving disputes between policyholders and insurers, including avenues for filing complaints and seeking redress.

Filing Complaints or Seeking Redress

If you encounter issues with your auto insurance provider, you have options for seeking resolution:

- Contact Your Insurance Company: Start by contacting your insurance company directly to explain the issue and attempt to resolve it through their internal complaint process.

- File a Complaint with Your State Insurance Department: If your issue remains unresolved, you can file a formal complaint with your state’s insurance department. They have the authority to investigate complaints and take action against insurers who violate state regulations.

- Seek Legal Counsel: In complex or serious situations, you may consider consulting with an attorney specializing in insurance law. They can provide legal advice and represent you in negotiations or legal proceedings.

Additional Resources

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization of state insurance regulators that provides information and resources on insurance regulations and consumer rights.

- Consumer Reports: Consumer Reports offers valuable information and ratings on auto insurance companies, helping you make informed choices.

Final Wrap-Up

By understanding the intricacies of auto insurance, you can make informed decisions to safeguard your financial well-being and ensure you have the right protection in case of an accident. Remember, the right auto insurance policy is not just a piece of paper; it’s a safety net that can help you navigate the unexpected and keep you on the road to peace of mind.