In the realm of personal finance, car insurance stands as a critical component, safeguarding individuals against the financial repercussions of unforeseen events. While minimum liability coverage fulfills basic legal requirements, opting for full car insurance coverage offers a comprehensive safety net, shielding you from the substantial costs associated with accidents, theft, and natural disasters.

This guide delves into the intricacies of full car insurance coverage, providing a detailed exploration of its core components, factors influencing costs, and the myriad benefits it offers. We’ll unravel the complexities of choosing the right plan, navigating claims processes, and exploring alternative options to ensure you make informed decisions that align with your individual needs and financial goals.

Understanding Full Car Insurance Coverage

Full car insurance coverage, often referred to as comprehensive car insurance, provides financial protection against a wide range of risks associated with owning and operating a vehicle. This type of coverage goes beyond the minimum requirements mandated by most states and offers a more robust safety net for drivers. Understanding the core components of full coverage is crucial for making informed decisions about your insurance needs and ensuring adequate financial protection.

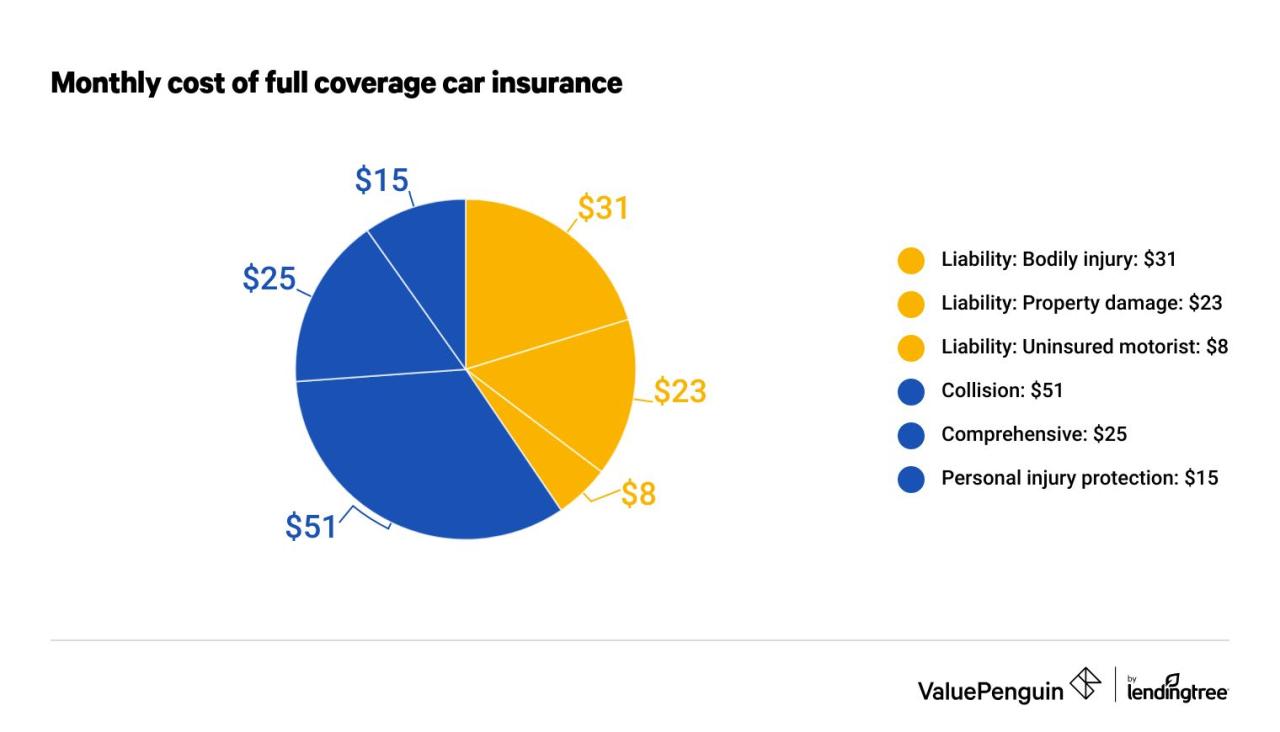

Components of Full Car Insurance Coverage

Full car insurance coverage typically includes four main components: liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each of these components serves a distinct purpose, providing protection against different types of risks.

Liability Coverage

Liability coverage is a fundamental component of car insurance, covering damages you cause to other people or their property in an accident. This coverage is typically required by law and helps protect you from significant financial losses in the event of an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries caused by your negligence.

- Property Damage Liability: This coverage pays for repairs or replacement costs for the other party’s vehicle or property damaged in an accident.

The amount of liability coverage you need depends on factors such as your state’s minimum requirements, your assets, and your driving habits.

Collision Coverage

Collision coverage protects you from financial losses if your vehicle is damaged in a collision with another vehicle or object, regardless of fault. This coverage pays for repairs or replacement costs, minus your deductible, for your own vehicle.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance company covers the remaining costs. Higher deductibles generally result in lower premiums.

- Actual Cash Value (ACV): Most collision coverage policies pay the actual cash value of your vehicle, which is its current market value minus depreciation.

Collision coverage is optional in most states but is often recommended for newer or more expensive vehicles.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses due to damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage also pays for repairs or replacement costs, minus your deductible.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance company covers the remaining costs.

- Actual Cash Value (ACV): Most comprehensive coverage policies pay the actual cash value of your vehicle, which is its current market value minus depreciation.

Comprehensive coverage is optional in most states, but it can be particularly beneficial for newer or more expensive vehicles.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you from financial losses if you are injured in an accident caused by a driver who is uninsured or has insufficient insurance coverage. This coverage pays for medical expenses, lost wages, and other damages incurred by you and your passengers.

- Uninsured Motorist Coverage: This coverage applies when the at-fault driver has no insurance.

- Underinsured Motorist Coverage: This coverage applies when the at-fault driver has insurance but the coverage limits are insufficient to cover your losses.

UM/UIM coverage is optional in most states but is highly recommended, as it can provide crucial financial protection in the event of an accident with an uninsured or underinsured driver.

Full Coverage vs. Minimum Liability Insurance

Full car insurance coverage provides a comprehensive level of protection, covering a wide range of risks. In contrast, minimum liability insurance only covers the minimum requirements mandated by your state, providing limited financial protection.

- Full Coverage: Includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Minimum Liability Insurance: Only covers bodily injury and property damage liability, typically required by law.

The decision of whether to purchase full coverage or minimum liability insurance depends on your individual needs, financial situation, and the value of your vehicle. Full coverage offers greater financial protection but also comes with higher premiums. Minimum liability insurance is less expensive but offers limited coverage.

Factors Influencing Full Coverage Costs

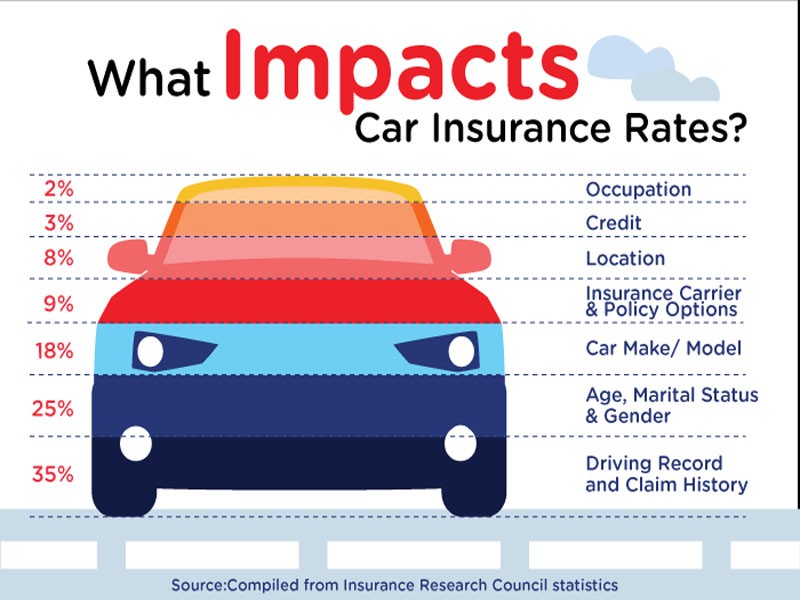

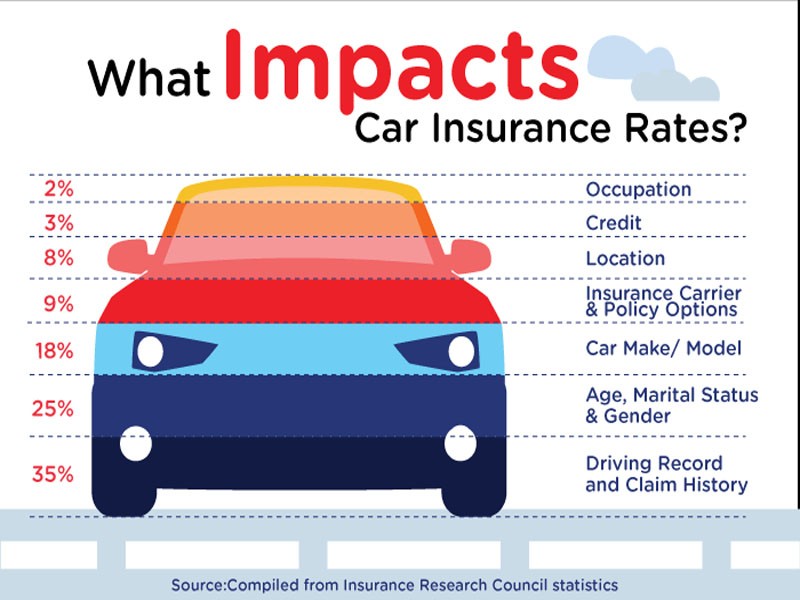

Numerous factors contribute to the cost of full car insurance coverage. These factors are analyzed by insurance companies to determine the risk associated with insuring a particular driver and vehicle. The higher the perceived risk, the higher the premium charged.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. High-performance vehicles, luxury cars, and expensive SUVs are often associated with higher repair costs and increased risk of theft. As a result, insurers charge higher premiums for these vehicles. Conversely, basic, reliable cars with a lower market value generally have lower premiums.

- Performance and Luxury: Sports cars, luxury sedans, and high-end SUVs are often targeted by thieves and have higher repair costs due to their complex engineering and expensive parts.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and lane departure warnings, may receive discounts as they reduce the likelihood of accidents and injuries.

Driving History

Your driving record is a crucial factor in determining your insurance premiums. A clean driving record with no accidents or traffic violations typically translates to lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions face higher premiums.

- Accidents: Insurers view drivers with a history of accidents as higher risk. The severity of the accident, the number of accidents, and the time since the last accident all contribute to the premium calculation.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations indicate a higher risk of future accidents.

- DUI Convictions: DUI convictions are viewed very seriously by insurers, leading to significantly higher premiums.

Location

The geographic location where you reside plays a significant role in your insurance premiums. Urban areas with higher population density and traffic congestion tend to have higher accident rates, leading to higher insurance premiums.

- Accident Rates: Areas with higher accident rates are considered riskier, resulting in higher premiums.

- Theft Rates: Locations with high theft rates, especially for certain vehicle models, can also impact insurance premiums.

- Natural Disasters: Areas prone to natural disasters, such as earthquakes, floods, or hurricanes, may have higher premiums due to the increased risk of damage to vehicles.

Age

Age is a factor in insurance premiums, reflecting the experience and driving habits of different age groups. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums generally decrease.

- Younger Drivers: Inexperience, risk-taking behavior, and a lack of driving history can lead to higher premiums for young drivers.

- Mature Drivers: Drivers over the age of 65 may also face higher premiums due to potential health issues and slower reaction times. However, some insurers offer discounts for mature drivers with clean driving records.

Credit Score

Credit score is an increasingly common factor used by insurers to assess risk. A good credit score is often associated with responsible behavior, which insurers view as a positive indicator of driving habits. Drivers with poor credit scores may face higher premiums.

- Credit History: Insurers use credit scores to gauge a driver’s financial responsibility and risk-taking behavior.

- Data Privacy: Some states have regulations limiting the use of credit scores in insurance pricing.

Impact of Factors on Insurance Costs

The following table illustrates how different factors can influence insurance premiums:

| Factor | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

|---|---|---|---|---|

| Vehicle Type | Basic Sedan | Luxury SUV | Sports Car | Hybrid Sedan |

| Driving History | Clean Record | One Accident | Multiple Violations | DUI Conviction |

| Location | Rural Area | Urban Area | High-Crime Area | Flood-Prone Zone |

| Age | 35 Years Old | 20 Years Old | 65 Years Old | 40 Years Old |

| Credit Score | Excellent | Poor | Fair | Good |

| Estimated Premium | $1,000/year | $1,500/year | $2,000/year | $3,000/year |

Note: The premiums in the table are hypothetical and will vary depending on the specific insurance company, coverage levels, and other factors.

Benefits of Full Car Insurance Coverage

Full car insurance, often referred to as comprehensive coverage, offers a robust safety net for vehicle owners, safeguarding them from significant financial losses in the event of accidents, theft, or natural disasters. While the upfront cost may seem substantial, the peace of mind and financial protection it provides can be invaluable in various situations.

Financial Protection in Case of Accidents

Full car insurance provides comprehensive coverage for various accident-related expenses, ensuring you are financially protected in the event of an accident, regardless of who is at fault. This protection encompasses:

- Collision Coverage: Covers repairs or replacement costs for your vehicle if it is damaged in a collision, even if you are at fault. For instance, if your car is totaled in a collision with another vehicle, collision coverage will reimburse you for the value of your vehicle, minus any deductible.

- Comprehensive Coverage: Protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, hailstorms, or floods. If your car is stolen or damaged by a natural disaster, comprehensive coverage will cover the repair or replacement costs, subject to your deductible.

- Liability Coverage: Protects you financially if you are responsible for causing an accident that results in injuries or property damage to others. This coverage pays for medical expenses, lost wages, and property damage claims filed against you.

Real-Life Examples of Full Coverage Benefits

Full car insurance has proven to be a lifeline in numerous real-life situations. Consider these examples:

- Accident with an Uninsured Driver: A driver with full coverage was involved in an accident with an uninsured driver. While the uninsured driver had no insurance to cover the damages, the insured driver’s full coverage policy compensated for the repairs to their vehicle, ensuring they didn’t bear the financial burden.

- Theft of a Vehicle: A vehicle owner with full coverage had their car stolen. The comprehensive coverage in their policy reimbursed them for the value of the stolen vehicle, allowing them to purchase a new car without significant financial strain.

- Damage from a Natural Disaster: A homeowner with full coverage experienced damage to their vehicle during a hailstorm. The comprehensive coverage in their policy covered the repair costs, preventing them from incurring substantial out-of-pocket expenses.

Comparison with Minimum Liability Insurance

While minimum liability insurance fulfills the legal requirements for driving, it offers limited financial protection compared to full coverage. Minimum liability insurance primarily covers damages to other people and their property if you are at fault in an accident. It does not cover your own vehicle’s damages or losses due to theft or natural disasters.

- Limited Protection for Your Vehicle: Minimum liability insurance does not cover repairs or replacement costs for your own vehicle in case of an accident or other damages. This means you would be responsible for all repair costs, which could be substantial in the event of a major accident.

- No Coverage for Theft or Natural Disasters: Minimum liability insurance does not provide any protection against theft or damage caused by natural disasters. If your vehicle is stolen or damaged by a hailstorm, you would be responsible for the entire cost of replacement or repair.

- Financial Risk in Case of an Accident: If you are involved in an accident and are at fault, minimum liability insurance will only cover damages to the other party. You would be responsible for any damages to your own vehicle, as well as any medical expenses or lost wages you incur.

Choosing the Right Full Coverage Plan

Navigating the world of full car insurance coverage can feel overwhelming, especially when you’re presented with a multitude of options. Choosing the right plan for your individual needs and risk tolerance is crucial for financial protection and peace of mind. A thoughtful approach, considering factors like deductibles, coverage limits, and discounts, can lead to a policy that offers optimal value.

Understanding Deductibles and Coverage Limits

Deductibles and coverage limits are two key components of full car insurance coverage that significantly impact the cost and scope of your policy.

Deductibles represent the amount you pay out of pocket for repairs or replacement before your insurance kicks in. A higher deductible typically translates to lower premiums, while a lower deductible results in higher premiums.

Coverage limits define the maximum amount your insurance company will pay for covered expenses, such as repairs, replacement costs, or medical bills. Higher coverage limits provide greater financial protection but come with higher premiums.

For example, if you have a $500 deductible and your car is damaged in an accident, you would pay the first $500 of the repair costs, and your insurance company would cover the rest up to your coverage limit.

When choosing a deductible and coverage limit, it’s essential to balance your financial capacity with your risk tolerance. Consider your financial situation, the value of your vehicle, and the likelihood of accidents or other covered events.

Tips for Negotiating Premiums and Securing Discounts

Negotiating your insurance premiums and maximizing discounts can significantly reduce your overall insurance costs. Here are some strategies to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online comparison tools can simplify this process.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Improve Your Driving Record: Maintain a clean driving record by avoiding traffic violations and accidents. Good driving habits can qualify you for lower premiums.

- Consider Safety Features: Vehicles equipped with advanced safety features, such as anti-theft systems, airbags, and anti-lock brakes, may qualify for discounts.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

- Negotiate with Your Current Provider: Don’t be afraid to negotiate with your current insurer. Explain your situation and inquire about potential discounts or adjustments to your policy.

Common Exclusions and Limitations

While full car insurance coverage offers comprehensive protection, it’s essential to understand its limitations. Certain events, conditions, or damages are specifically excluded from coverage, and policyholders should be aware of these exceptions to avoid unexpected financial burdens.

Wear and Tear

Wear and tear refers to the gradual deterioration of a vehicle’s components due to normal use over time. Full car insurance policies generally do not cover damages resulting from wear and tear. For instance, a worn-out tire or a cracked windshield caused by age and exposure to the elements would not be covered under a full car insurance policy.

Pre-Existing Conditions

Pre-existing conditions are defects or problems that existed before the insurance policy was purchased. These conditions are usually not covered by full car insurance policies. For example, if a vehicle had a faulty engine before the policy was taken out, any damage related to that engine would likely be excluded from coverage.

Certain Types of Accidents

Full car insurance policies often have limitations regarding specific types of accidents. For example, accidents caused by driving under the influence of alcohol or drugs, or accidents involving illegal activities, may be excluded from coverage. Additionally, some policies may have limitations on coverage for accidents that occur outside the insured’s designated geographic area.

Other Exclusions

- Acts of God: Natural disasters such as earthquakes, floods, and volcanic eruptions are typically excluded from full car insurance policies.

- War and Terrorism: Damage caused by war or acts of terrorism is generally not covered.

- Mechanical Breakdown: Full car insurance policies do not cover routine maintenance or repairs related to mechanical failures.

- Cosmetic Damage: Minor scratches, dents, or other cosmetic damage may not be covered if the damage is considered insignificant.

Implications for Policyholders

Understanding these exclusions and limitations is crucial for policyholders as it helps them avoid potential disputes and ensure that their coverage aligns with their needs. For instance, if a policyholder is aware that their policy excludes coverage for wear and tear, they can budget for routine maintenance and repairs to prevent unexpected expenses.

Examples of Denied or Limited Coverage

- Wear and Tear: A policyholder’s car develops a leak in the radiator due to rust and corrosion. This damage is considered wear and tear and would likely be denied coverage.

- Pre-Existing Conditions: A policyholder’s car has a pre-existing issue with the transmission. The transmission fails shortly after the policy is purchased, and the claim is denied because the issue existed before the policy was taken out.

- Certain Types of Accidents: A policyholder is involved in an accident while driving under the influence of alcohol. The insurance company may deny coverage or limit the payout due to the driver’s negligence.

Understanding Claims and Processes

Navigating the process of filing a car insurance claim can feel daunting, but understanding the steps involved and the role of your insurance company can make the experience smoother. This section Artikels the key aspects of the claims process, from initial notification to final resolution.

Filing a Claim

Once you’ve been involved in an accident, it’s crucial to promptly notify your insurance company. This typically involves contacting your insurer via phone, email, or through their online portal. The initial notification should include details about the accident, such as the date, time, location, and parties involved.

- Documentation: Gather essential documentation to support your claim, including:

- Police report (if applicable)

- Photos and videos of the accident scene and vehicle damage

- Contact information of all parties involved

- Witness statements

- Medical records (if applicable)

- Claim Form: Your insurance company will provide you with a claim form to complete, detailing the circumstances of the accident and the extent of the damage.

- Inspection: Depending on the nature of the claim, an insurance adjuster may inspect your vehicle to assess the damage and determine the repair or replacement costs.

Insurance Company’s Role

Your insurance company plays a critical role in investigating and resolving your claim.

- Investigation: The insurer will review the submitted documentation and conduct a thorough investigation to verify the details of the accident. This may involve contacting witnesses, reviewing police reports, and conducting independent investigations.

- Negotiation: The insurer will negotiate the settlement amount with you based on the assessed damage, policy coverage, and applicable laws.

- Payment: Once the claim is approved, the insurance company will issue payment for repairs, replacement costs, medical expenses, or other covered losses.

Factors Affecting Claim Settlement

Several factors can influence the time it takes to settle a claim and the outcome of the settlement.

- Complexity of the Claim: Claims involving multiple parties, significant damage, or legal disputes tend to take longer to resolve.

- Availability of Information: The timely submission of complete and accurate documentation can expedite the claim process.

- Policy Coverage: The specific terms and conditions of your insurance policy, including deductibles, coverage limits, and exclusions, will determine the amount of compensation you receive.

- Cooperation of Parties: The cooperation of all parties involved, including the insured, the other driver, and any witnesses, can significantly impact the claim settlement timeline.

Tips for Maintaining Full Coverage

Maintaining full car insurance coverage requires a proactive approach, encompassing safe driving habits, regular vehicle maintenance, and responsible financial management. By adhering to these practices, you can not only ensure continuous coverage but also potentially lower your premiums over time.

Safe Driving Practices

Safe driving is paramount in maintaining full car insurance coverage. Driving violations and accidents can significantly impact your premiums and even lead to policy cancellations.

- Obey Traffic Laws: Adhering to speed limits, traffic signals, and other road regulations is crucial. Violations can result in points on your driving record, leading to higher premiums.

- Avoid Distracted Driving: Distracted driving, such as texting or talking on the phone while driving, increases the risk of accidents. Focus on the road ahead and avoid distractions.

- Maintain a Safe Distance: Leave sufficient space between your vehicle and others to react to unexpected situations. Tailgating can lead to accidents and higher premiums.

- Avoid Aggressive Driving: Aggressive driving, such as speeding, tailgating, or weaving through traffic, increases the likelihood of accidents and higher premiums.

- Drive Defensively: Anticipate potential hazards and be prepared to react quickly and safely. Defensive driving techniques can minimize the risk of accidents.

Regular Vehicle Maintenance

Regular vehicle maintenance plays a crucial role in maintaining full car insurance coverage. By ensuring your car is in good working order, you can minimize the risk of accidents and breakdowns.

- Regular Oil Changes: Regular oil changes are essential for engine health and performance. Neglecting oil changes can lead to engine damage and potential breakdowns.

- Tire Maintenance: Proper tire inflation and tread depth are critical for safe driving. Underinflated or worn tires can lead to accidents and increase the risk of breakdowns.

- Brake Inspections: Regular brake inspections ensure optimal braking performance. Worn or faulty brakes can lead to accidents and safety concerns.

- Fluid Checks: Regularly check fluid levels, including coolant, brake fluid, and windshield washer fluid. Low fluid levels can lead to engine overheating, brake failure, or visibility issues.

- Battery Checks: A weak or failing battery can lead to unexpected breakdowns. Regular battery checks ensure a reliable starting system.

Responsible Financial Management

Maintaining full car insurance coverage often involves responsible financial management. By managing your finances effectively, you can avoid policy lapses and ensure continuous coverage.

- Budgeting: Create a budget that includes your insurance premiums. Ensure that you have sufficient funds to pay your premiums on time.

- Payment Schedule: Understand your payment schedule and ensure timely payments. Late payments can lead to penalties and even policy cancellations.

- Financial Planning: Consider your financial goals and plan for unexpected expenses, such as car repairs or accidents. Having a financial plan can help you manage insurance costs and avoid coverage gaps.

- Savings: Maintain an emergency fund to cover unexpected expenses, such as car repairs or accidents. Having savings can help you avoid relying on insurance for minor issues.

- Debt Management: Manage your debt responsibly. High debt levels can impact your credit score, potentially leading to higher insurance premiums.

Avoiding Insurance Scams and Fraud

Insurance scams and fraud can be costly and jeopardize your coverage. Be vigilant and informed to protect yourself from these practices.

- Beware of Phishing Emails: Be cautious of emails requesting personal information or asking you to click on suspicious links. Legitimate insurance companies will never ask for sensitive information via email.

- Verify Information: Always verify information with your insurance company before providing any personal details or making payments.

- Report Suspicious Activity: If you suspect fraud or suspicious activity, report it to your insurance company and local authorities.

- Understand Your Policy: Read your insurance policy carefully and understand your coverage. This will help you identify potential scams or fraudulent claims.

- Be Aware of Common Scams: Stay informed about common insurance scams, such as staged accidents, fake claims, and identity theft.

Alternative Options to Full Coverage

While full coverage car insurance offers comprehensive protection, it can be expensive. For drivers who don’t need the full scope of coverage or are looking to save money, alternative options exist. These alternatives can provide adequate protection while reducing premiums.

Limited Coverage Plans

Limited coverage plans provide less comprehensive protection than full coverage but can be more affordable. They typically cover the essentials, such as liability and collision coverage, but may exclude certain types of damage or events.

- Liability Coverage: This coverage protects you financially if you’re at fault in an accident that causes damage to another person’s property or injuries.

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in a collision, regardless of who is at fault.

Limited coverage plans are suitable for drivers with older vehicles or those with a lower risk tolerance. They can also be a good option for drivers who are comfortable assuming more financial responsibility in the event of an accident.

Usage-Based Insurance Programs

Usage-based insurance programs, also known as telematics programs, track your driving habits and offer discounts based on your driving behavior. These programs typically use a device plugged into your car’s diagnostic port or a smartphone app to monitor your driving habits, such as speed, acceleration, braking, and time of day.

- Discounts: Drivers who demonstrate safe driving habits, such as avoiding hard braking and speeding, can earn significant discounts on their premiums.

- Data Privacy: Some drivers may have concerns about data privacy as these programs collect personal driving data.

Usage-based insurance programs can be particularly beneficial for drivers who drive less frequently, have a good driving record, or are willing to adjust their driving habits to save money.

Other Alternative Options

Besides limited coverage plans and usage-based insurance programs, other alternatives to full coverage include:

- Deductible Waivers: These waivers cover your deductible in the event of an accident, reducing your out-of-pocket expenses.

- Gap Insurance: This coverage helps bridge the gap between the actual cash value of your vehicle and the outstanding loan balance if your vehicle is totaled.

- Rental Reimbursement: This coverage pays for a rental car if your vehicle is damaged in an accident or undergoing repairs.

These options can be tailored to your specific needs and budget, allowing you to customize your coverage and potentially save money.

The Future of Full Car Insurance Coverage

The automotive landscape is undergoing a rapid transformation, driven by technological advancements and evolving consumer preferences. This revolution is also impacting the car insurance industry, prompting insurers to adapt their strategies and products to meet the changing needs of their customers. The future of full car insurance coverage is likely to be shaped by several emerging trends, including telematics, autonomous vehicles, and predictive analytics.

The Impact of Telematics

Telematics refers to the use of technology to collect and analyze data related to vehicle usage. Telematics devices, such as GPS trackers and onboard computers, can monitor driving behavior, vehicle performance, and location. This data can be used by insurers to assess risk more accurately and offer personalized insurance premiums based on individual driving habits.

- Reduced Premiums for Safe Drivers: Insurers can reward safe drivers with lower premiums based on their driving data. This encourages safer driving practices and promotes a more equitable pricing structure.

- Enhanced Risk Assessment: Telematics data provides a more comprehensive picture of driving behavior, allowing insurers to identify high-risk drivers and adjust premiums accordingly.

- Improved Claims Handling: Telematics data can assist in investigating claims by providing accurate information about the incident, such as speed, location, and braking patterns.

The Rise of Autonomous Vehicles

The advent of autonomous vehicles (AVs) is expected to have a significant impact on the car insurance industry. AVs are designed to operate without human intervention, potentially reducing the number of accidents caused by human error. This could lead to lower insurance premiums and a shift in the focus of insurance coverage.

- Liability and Responsibility: Determining liability in accidents involving AVs will be a complex issue. Insurance companies will need to adapt their policies to address the unique challenges posed by autonomous vehicles.

- New Coverage Options: Insurance policies may need to include coverage for cyberattacks, software glitches, and other risks specific to AVs.

- Potential for Usage-Based Insurance: As AVs become more prevalent, insurers may adopt usage-based insurance models, where premiums are based on the distance traveled or the time the vehicle is in use.

The Role of Predictive Analytics

Predictive analytics involves using data and algorithms to forecast future events. In the context of car insurance, predictive analytics can be used to identify potential risks, predict claims frequency, and personalize insurance policies.

- Targeted Risk Management: Insurers can use predictive analytics to identify high-risk drivers and offer them targeted safety programs or discounts for adopting safe driving habits.

- Personalized Pricing: Predictive models can help insurers develop more accurate and personalized pricing structures based on individual risk profiles.

- Fraud Detection: Predictive analytics can be used to identify and prevent fraudulent claims, reducing insurance costs for all policyholders.

Adapting to the Changing Landscape

Insurance companies are actively adapting to these emerging trends to remain competitive. Many insurers are investing in telematics technology, developing new insurance products for AVs, and adopting predictive analytics to improve risk assessment and pricing.

- Partnerships with Tech Companies: Insurers are collaborating with technology companies to develop innovative insurance solutions and integrate telematics into their offerings.

- Data-Driven Decision Making: Insurers are leveraging big data and analytics to gain insights into customer behavior and market trends.

- Customer-Centric Approach: Insurers are focusing on providing personalized and transparent insurance experiences to meet the evolving needs of their customers.

Case Studies and Real-World Examples

Understanding the benefits and challenges of full car insurance coverage is best done through real-world examples. These case studies demonstrate how full coverage can protect you in various situations and highlight the potential downsides you need to consider.

Illustrative Case Studies

Here are some examples of how full car insurance coverage can play out in real life:

| Scenario | Coverage Type | Outcome | Lessons Learned |

|---|---|---|---|

| A driver loses control of their car on a snowy road and collides with a parked vehicle, causing significant damage to both vehicles. | Collision and Comprehensive Coverage | The insurance company covers the repairs for both vehicles, including the deductible. | Full coverage protects you from financial hardship when accidents happen, even if you’re not at fault. |

| A driver’s car is stolen from their driveway. | Comprehensive Coverage | The insurance company covers the cost of a replacement vehicle, minus the deductible. | Comprehensive coverage protects you from losses due to theft, vandalism, and other non-collision events. |

| A driver is involved in a hit-and-run accident and the other driver cannot be identified. | Uninsured/Underinsured Motorist Coverage | The insurance company covers the driver’s medical expenses and vehicle repairs, up to the policy limits. | Uninsured/underinsured motorist coverage protects you when the other driver is uninsured or doesn’t have enough coverage to cover your losses. |

“It’s important to remember that full coverage doesn’t mean you’re completely protected. There are still deductibles, limits, and exclusions to consider.”

Sharing Your Experiences

We encourage you to share your own experiences with full car insurance coverage. Have you ever benefited from having full coverage? Have you ever encountered any limitations or challenges? Sharing your stories can help others make informed decisions about their own insurance needs.

Ending Remarks

Understanding full car insurance coverage is paramount for responsible car ownership. By carefully analyzing your needs, exploring available options, and maintaining a proactive approach to risk management, you can secure a comprehensive insurance plan that provides peace of mind and financial protection. As the automotive landscape continues to evolve, embracing technological advancements and adapting to changing insurance practices will be crucial in ensuring optimal coverage for the future.